As the United States advances into 2025, a variety of economic projections and analyses contribute to a mosaic of expectations surrounding growth prospects, price stability, labor market conditions, and the broader policy environment. The year appears to be defined by measured optimism set against a backdrop of lingering concerns, resulting in forecasts that reflect both supportive drivers of expansion and potential headwinds poised to disrupt momentum. In examining an array of insights from financial institutions, consulting firms, think tanks, and economic observers, it becomes clear that 2025 represents a moment of important transition in which critical policy decisions, global developments, and structural shifts will all converge to determine the nation’s economic course.

Although the foundation for continued growth remains robust in certain areas, economists emphasize that the delicate balance between stability and volatility hinges on domestic factors—such as monetary policy adjustments, fiscal initiatives, and labor market developments—as well as global influences that can swiftly alter the trajectory of key sectors. Accordingly, forecasts for U.S. gross domestic product (GDP) growth, inflation levels, and employment trends are set against a continuum ranging from moderate optimism to measured caution. Within this framework, businesses, investors, and policymakers are tasked with navigating the complexities of an ever-evolving economic landscape, recognizing that the interplay between policy direction and market forces will be pivotal in shaping outcomes.

This article provides an in-depth, third-person analysis of the latest economic projections for the United States in 2025. By exploring various facets of the economy, including growth indicators, inflation trends, labor force dynamics, policy shifts, industry-specific developments, and external pressures, it outlines how these factors may coalesce in the months ahead. The discussion begins with a review of 2025 GDP forecasts from several sources, followed by an examination of inflationary signals, labor market shifts, the monetary and fiscal policy environment, sector-by-sector outlooks, and potential risks that could alter the central scenario. Although overall sentiment remains guardedly optimistic, the possibilities of intermittent turbulence and unforeseen global events underscore the need for vigilance at every level of economic decision-making.

Links to resources such as Goldman Sachs, Deloitte, Vanguard, OECD, and Trading Economics are provided throughout, enabling readers to explore additional data and perspectives on the evolving economic climate. By weaving together diverse viewpoints, this analysis seeks to offer a balanced portrayal of the opportunities and challenges that will shape the U.S. economy in 2025.

A Year of Transition: Contextualizing 2025

Economic forecasts for 2025 emerge against a backdrop characterized by transitions in both policy and global markets. Over the preceding years, the U.S. economy displayed remarkable adaptability to a variety of shocks and disruptions, prompting analysts to weigh the long-term implications of structural changes—particularly in areas such as labor force participation, supply-chain vulnerabilities, and technological innovation. Heading into 2025, many economists underscore that while the economy has repeatedly proven its resilience, it remains susceptible to geopolitical influences, domestic policy shifts, and the reverberations of complex trade alignments.

Market observers note that 2024 concluded with a sense of cautious positivity, shaped by steady if somewhat subdued GDP growth, a labor market that continued to exhibit low unemployment rates, and ongoing debates about the direction of fiscal policy under new political leadership. By 2025, decisions made by policymakers in the prior year began taking effect, particularly with regard to proposed tax reforms, trade negotiations, and immigration policy changes. Analysts argue that these modifications will reverberate across industries, influencing consumer spending patterns, corporate investment decisions, and sector-specific competitiveness in the coming quarters.

Against this environment, leading financial institutions converged on a moderate growth outlook. While forecasts vary among organizations, their projections share a view that 2025 will likely sustain forward momentum—though not at the breakneck pace observed in some prior expansions. Instead, the narrative focuses on a more measured progression, driven by solid consumer demand, improving supply chains, and strategic investments in technology and infrastructure. Within this general framework, economic forecasters remain divided on whether looming external uncertainties could trigger unexpected volatility.

GDP Growth Outlook

Goldman Sachs’ Projection: Resilience Amid Policy Uncertainty

Goldman Sachs forecasts that real GDP growth will reach approximately 2.5% in 2025. This figure situates the U.S. economy at a growth rate that, while not exceptionally high, surpasses many peers in developed markets. The banking institution’s research department attributes its relatively optimistic stance to a combination of strong fundamentals and the expectation that policy changes under the Republican administration will not drastically disrupt existing monetary or fiscal dynamics. In particular, Goldman Sachs analysts highlight diminishing recession fears, which were prevalent in certain segments of the market as recently as 2023 and 2024. The emphasis on a rebalanced labor market and the waning effects of earlier supply-chain bottlenecks further reinforce the view that steady expansion is likely.

The emphasis on resilience can be traced to several important trends. First, capital investment in automation, digitalization, and artificial intelligence (AI) appears poised to support productivity gains, though the extent to which these technological advancements diffuse across various industries remains uncertain. Second, modest improvements in global demand suggest that American exporters could benefit from stabilizing conditions abroad, as long as elevated trade tensions do not materialize in a manner that restricts flows of goods. Finally, flexible monetary policy—supported by the Federal Reserve’s data-driven approach—provides a measure of reassurance to businesses and investors, mitigating the likelihood of abrupt rate hikes that could derail the recovery.

The More Conservative Deloitte View: Slowing Growth Trajectory

Deloitte’s 2025 projection offers a more conservative figure of around 1.6% GDP growth, reflecting heightened caution about several risk factors on the horizon. Chief among these concerns is the possibility that persistent global uncertainties regarding trade and foreign policy could erode consumer confidence. In Deloitte’s baseline scenario, the strength of the consumer sector remains important, but worries linger that renewed trade tensions might undermine household purchasing power, especially if tariffs or supply disruptions drive higher prices on imported goods.

Another element impacting Deloitte’s forecast is the effect of tightening credit conditions on mid-size firms. Despite improved financial markets relative to earlier periods, there is recognition that elevated borrowing costs—especially if short-term interest rates do not decline as quickly as hoped—could discourage business expansion and dampen hiring plans. This scenario builds on the premise that the Federal Reserve, wary of inflationary pressures, may feel compelled to maintain a more restrictive monetary stance for longer. As a result, credit availability for less established or more leveraged companies could decline, constraining growth.

That said, Deloitte’s analysis does not entirely dismiss the possibility of upside surprises. If policy shifts regarding immigration lead to an increase in labor supply, it could partially offset wage pressures, enabling broader hiring without sparking sharp inflation spikes. Similarly, if trade negotiations stabilize, the U.S. could see a return of foreign investment, thus pushing actual growth beyond the conservative baseline. Nonetheless, Deloitte’s 1.6% projection underscores a view that the economy may not sustain the stronger expansion rates that some other institutions envision for 2025.

OECD Estimates and Broader International Comparisons

The Organisation for Economic Co-operation and Development (OECD) offers a perspective that aligns more closely with Goldman Sachs, anticipating 2.4% growth. This middle-ground estimate arises from a framework that sees progress on structural challenges—such as supply-chain realignments—helping keep the economy afloat. OECD analysts also suggest that the U.S. consumer remains relatively robust, with low unemployment and rising incomes driving spending on services and durable goods, though unevenly across different demographic segments.

Internationally, the U.S. projection for 2025 compares favorably to many European nations, some of which continue to grapple with energy price volatility and longer-lasting aftershocks from past trade disruptions. In Asia, certain economies are forecast to grow more quickly than the United States, but these emerging and frontier markets often face their own challenges related to capital flows and structural reforms. Thus, the OECD underscores that the U.S. economy holds a position of relative stability among advanced nations, though it remains imperative to navigate the shifting policy environment in a way that preserves investment incentives and cultivates consumer confidence.

IMF Contribution and Overall Consensus

Although not linked here, the International Monetary Fund (IMF) contributes an outlook of approximately 2.2% growth. This figure positions the U.S. economy somewhere between the moderate optimism of Goldman Sachs and the more conservative view of Deloitte. While growth rates around 2% may appear modest from a historical perspective, the IMF’s analysis underscores how an aging workforce, global competition, and persistent policy debates can constrain growth potential. Nonetheless, the general consensus across major forecasters is that the U.S. economy in 2025 will continue moving forward at a pace that, while not extraordinary, is stable enough to sustain labor market progress and incremental rises in productivity.

Inflation and Price Stability

Reaching for the 2% Target

Inflation occupies a central place in the conversation about economic projections for 2025. Goldman Sachs, while relatively optimistic on growth, believes that inflation may trend back toward the Federal Reserve’s 2% target. This scenario suggests that some of the more pressing inflationary pressures seen in earlier periods—often linked to supply-chain disruptions—are gradually abating as global production networks stabilize. Additionally, improvements in technology-driven productivity gains may provide relief on the cost side, limiting price increases for both consumer goods and business inputs. For policymakers, an environment of low or moderate inflation can allow for a more measured approach to interest rates, reducing the likelihood of abrupt tightening or loosening.

Persistent Pressures and Policy Risks

In contrast to the benign view, some analysts, including those at Deloitte, highlight risks of sticky inflation that could remain above target levels for a protracted period. One potential source of upward price pressure involves immigration and labor market policy. If stricter rules limit the available pool of workers across critical industries—ranging from agriculture to high-tech—wage pressures could intensify, prompting employers to raise prices in order to maintain margins. In addition, trade disputes or tariff escalations could pass added costs on to consumers, especially if critical imports face higher duties.

Under such circumstances, achieving a balanced approach to monetary policy becomes more challenging. Should inflation remain stubbornly above the 2% target, the Federal Reserve might see little choice but to keep interest rates at comparatively higher levels, potentially dampening credit growth and discretionary spending. This trade-off underscores the delicate balance policymakers must maintain between pursuing growth-oriented objectives and ensuring that inflation does not spiral out of control. An environment of consistent price pressures can undermine household purchasing power, creating a drag on consumer sentiment, which typically constitutes a cornerstone of the U.S. economy.

Vanguard’s Perspective on Core Inflation

Vanguard’s outlook for 2025 projects that core inflation—the measure excluding volatile food and energy prices—could hover around 2.5% for a significant portion of the year. This figure sits modestly above the Federal Reserve’s ideal target, suggesting that policymakers might opt for gradual interest rate hikes to forestall the risk of accelerating inflation. On one hand, Vanguard’s analysts recognize that robust capital spending in technology could mitigate certain supply bottlenecks, thereby easing cost burdens across multiple sectors. On the other hand, the company warns that inflation could be exacerbated by possible shifts in immigration policy that lead to a labor shortage in specific regions, thus fueling faster wage growth and, by extension, higher prices.

The net effect of these dynamics hinges heavily on the timing and scope of policy decisions. If policymakers implement measures that expand the labor pool and preserve fluid trade relations, inflation might remain relatively contained. Conversely, protectionist impulses or a policy environment that restricts labor inflows may ignite price pressures. By the end of 2025, Vanguard projects that inflation could moderate somewhat if supply-side factors align favorably, but the institution advises monitoring early indicators closely to detect any signs of renewed inflationary momentum.

Labor Market Conditions and Employment Trends

Evolving Unemployment Rates

Labor market projections for 2025 indicate a continued trend of strong, though potentially moderating, employment growth. Goldman Sachs anticipates that the unemployment rate will hover around 4.4%, marking a slight increase from the sub-4% levels witnessed in stronger expansionary periods but still signifying a relatively tight labor market. This equilibrium reflects the interplay between steady job creation and a broader labor force participation rate. Even as some industries face structural changes driven by automation and shifting consumer preferences, overall hiring sentiment remains positive.

Deloitte's analysis adopts a nuanced viewpoint, positing that the labor market’s trajectory will depend partly on immigration policy. If policies become more accommodating, expanding the labor force, wage pressures might moderate slightly, which in turn could keep inflation in check. A larger pool of available workers may also alleviate some of the bottlenecks that companies have faced in finding specialized skills, especially in technology-oriented domains. Simultaneously, however, the risk of increased unemployment in sectors vulnerable to global competition or automation persists. Economists note that segments of the workforce lacking up-to-date technical skills could experience displacement if technological adoption accelerates in manufacturing, logistics, and customer-facing services.

Shifts in Employment Composition

The structure of employment is likely to change in 2025, with technology-driven sectors gaining momentum. As companies invest more heavily in AI, data analytics, and cloud infrastructure, demand for software engineers, data scientists, and other specialized professionals could continue rising. Concurrently, certain routine-based roles may experience downward pressure, underscoring the need for workforce retraining and upskilling initiatives.

Commentators observe that this evolution in the labor market might be an impetus for regional development. States that successfully attract investment in high-growth sectors could see robust job creation and wage gains, potentially leading to migration from areas slow to adapt. In addition, some analysts identify an increased appetite among businesses to explore previously underutilized talent pools, such as rural communities or traditionally marginalized demographics, as they seek to expand workforce participation in an era of continuing skill shortages.

Monetary Policy Outlook

Federal Reserve’s Balancing Act

The Federal Reserve’s approach to interest rates and balance sheet management stands at the heart of 2025’s economic discussion. While the Fed operates independently, it remains sensitive to the broader policy environment, global economic conditions, and domestic inflationary pressures. With many analysts projecting that inflation could hover near or slightly above the 2% target, the consensus is that the central bank will maintain a cautious stance on interest rate adjustments.

Goldman Sachs asserts that modest rate cuts in early 2025—intended to support a potentially cooling economy—might quickly give way to a holding pattern if inflation creeps upward. The Fed may, therefore, find itself walking a tightrope: cutting rates sufficiently to spur growth without reigniting uncomfortably high inflation. If price pressures prove stickier than anticipated, the institution may need to revert to incremental hikes, albeit carefully timed and communicated to minimize disruptions to credit markets.

Influence of Fiscal Policy and Market Sentiment

Federal Reserve decisions do not exist in a vacuum; fiscal policy measures can either reinforce or counteract the central bank’s objectives. Tax cuts or infrastructure spending initiatives, for instance, could infuse additional liquidity into the economy, spurring consumption and investment but also increasing the risk of overheating. Market participants frequently scrutinize signals from policymakers in Washington, especially if proposed legislation has the potential to shift consumer behavior or alter risk appetites in financial markets.

Observers note that a strong stock market, robust corporate earnings, and healthy household balance sheets can also embolden the Fed to adopt a more hands-off approach if inflation remains near target. However, any evidence of speculative bubbles—perhaps in real estate or technology—could prompt the central bank to reassess. Maintaining clear communication with the public and markets remains crucial as the Fed navigates these complexities, striving to uphold its dual mandate of price stability and maximum employment.

Fiscal Policy Initiatives

Tax and Spending Proposals

Political developments in Washington continue to shape the fiscal environment in 2025, with policymakers debating various proposals that could impact the economy’s growth trajectory. Analysts point to measures aimed at corporate tax restructuring, infrastructure improvements, and incentives designed to spur research and development. Supporters of these initiatives argue that they can further drive U.S. competitiveness, boost productivity, and expand job opportunities in emerging sectors like renewable energy and advanced manufacturing.

However, critics caution that an overly aggressive fiscal expansion could lead to rising deficits, potentially sparking inflationary pressures and elevating long-term interest rates if the government issues new debt to fund spending. Given the divided viewpoints within the legislative sphere, it remains uncertain which specific proposals will gain traction. Deloitte’s conservative growth forecast, for instance, factors in the possibility that policy gridlock could delay or water down bold spending measures, limiting their immediate impact on headline GDP.

Trade Policy: Between Tension and Resolution

Trade policy remains a wildcard for U.S. growth prospects. While many economists agree that an open, rules-based trading system fosters long-term efficiency and innovation, political dynamics have at times induced strains in key relationships with major trading partners. The potential imposition of tariffs or other barriers can disrupt supply chains and introduce uncertainty, discouraging business investment. On the flip side, successful negotiations that lower barriers could pave the way for expanded exports and attract foreign direct investment.

As of 2025, major trade negotiations with certain regions are ongoing, with both constructive dialogue and occasional rhetorical flare-ups reported. The business community tends to view stable trade agreements as conducive to predictable business planning, enabling firms to allocate capital more effectively. Analysts note that while a complete rollback of trade tensions might not be imminent, pragmatic compromises could help maintain the steady flow of goods and services, to the benefit of the broader economy. Nonetheless, any abrupt escalation in trade disputes has the potential to upset projections and necessitate quick adjustments by businesses that rely on global supply chains.

Sector-by-Sector Outlook

Manufacturing

Manufacturing, a sector historically sensitive to economic cycles, stands at a crossroads in 2025. On one hand, improved supply-chain efficiency and the adoption of advanced automation technology offer new avenues for growth, as companies strive to maintain cost competitiveness. Some multinational manufacturers, lured by stable domestic demand and supportive business environments, continue to expand production capacity in the United States. Others invest in retraining programs for workers, aiming to transition from traditional assembly-line tasks toward higher-skilled roles focusing on machine programming, maintenance, and quality control.

Yet challenges persist. A resurgence of global protectionist measures or a sharp uptick in commodity prices could place pressure on U.S. manufacturers, particularly those reliant on imported inputs. Additionally, smaller manufacturers face the hurdle of securing the capital needed for modernization. Observers contend that the sector’s performance will hinge on how effectively companies adapt to technological transformations, manage trade risks, and align with evolving consumer preferences for sustainability and customization.

Services

The services sector, encompassing financial services, healthcare, technology, retail, and other professional specialties, remains the primary engine of U.S. economic growth. Forecasters expect robust service-related activity to continue well into 2025, propelled by stable consumer spending on both essential and discretionary items. The shift toward e-commerce and digital platforms, accelerated by broad-based acceptance of online transactions, fosters new opportunities for service providers to expand their offerings.

Financial services firms see a diverse range of conditions. Some benefit from higher interest rates that expand margins, while others experience tighter regulatory scrutiny aimed at preventing systemic risks. Healthcare spending, which has historically grown faster than inflation, is projected to continue its upward trajectory, reflecting an aging population and ongoing medical innovations. However, analysts highlight that rising costs may eventually prompt policymakers to seek new efficiency measures or cost controls. Technology services, meanwhile, stand out for rapid expansion, aided by the continued surge in demand for digital solutions, cybersecurity, and data analytics in virtually every industry.

Real Estate

Real estate activity in 2025 varies by region and market segment. Residential housing demand remains relatively robust in metropolitan areas experiencing strong job growth, driven by technology, finance, or a concentration of corporate headquarters. However, housing affordability concerns have intensified in cities with limited housing supply and high population inflows, prompting some workers to migrate toward suburban or smaller urban regions offering more competitive pricing.

Commercial real estate—a sector sensitive to broader macroeconomic trends—sees pockets of strength in logistics and warehousing, fueled by the sustained rise of e-commerce and the need for optimized distribution networks. Office space demand presents a mixed picture: while certain companies reduce their footprints due to remote work arrangements or reconfigured workplace models, others expand in key markets to accommodate a growing workforce. Analysts generally expect moderate overall growth in real estate, with an emphasis on properties that align with new consumer and corporate preferences for flexibility, convenience, and sustainability features.

Technology

By 2025, the technology sector cements its role as a driving force behind U.S. productivity gains and global competitiveness. Innovations in AI, machine learning, quantum computing, and other cutting-edge fields promise to transform industries ranging from healthcare to finance. As tech firms race to commercialize breakthroughs, they often forge partnerships with manufacturing, logistics, and retail companies seeking to enhance efficiency or capture untapped revenue streams. These synergies help propel economic growth, though they also disrupt traditional labor markets by automating routine tasks.

Cloud computing remains a major growth area, with businesses of all sizes migrating to software-as-a-service (SaaS) platforms that offer scalability and cost savings. The rise of data-driven decision-making likewise intensifies demand for skilled data scientists, analysts, and system architects, prompting educational institutions and private sector partnerships to ramp up training programs. However, concerns about privacy, cybersecurity, and monopolistic tendencies among tech giants persist, ensuring that regulatory scrutiny remains a key component of the sector’s outlook. Observers expect that effective regulatory frameworks, if appropriately targeted, could foster healthy competition and safeguard consumer rights without stifling innovation.

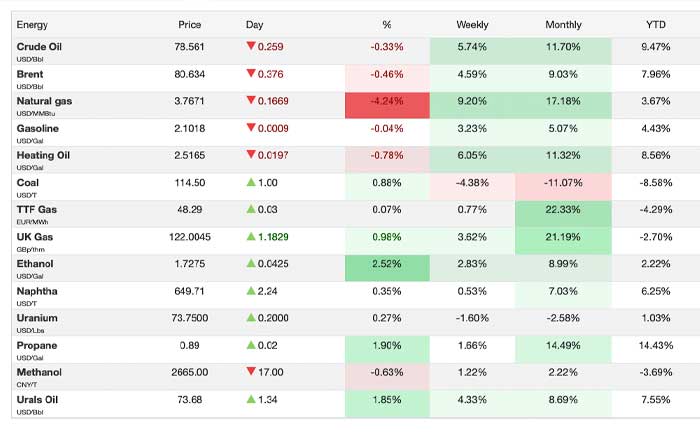

Energy

The energy landscape in 2025 combines elements of traditional fossil-fuel production and rapid renewables expansion. Oil and gas producers, adapting to global calls for sustainable development, continue to deploy advanced drilling and extraction technologies that reduce environmental impacts and improve operational efficiency. Simultaneously, the renewable energy sector, particularly solar and wind, sees rising investment levels as power companies respond to public demand and technological progress that drives down installation and maintenance costs.

Analysts caution that the sector’s performance depends on the balance between federal and state-level regulatory environments. Policies aimed at accelerating the energy transition—through subsidies, tax incentives, or mandatory renewable energy quotas—can spur investment and job creation but may also influence commodity markets. Regions with favorable resource endowments, such as sun-rich states for solar or windy plains for onshore wind, are often the primary beneficiaries of these developments. Overall, energy market dynamics will likely remain highly sensitive to global prices, technological breakthroughs, and the evolving societal consensus on climate-related issues.

US GDP Growth Forecasts for 2025

External Factors Affecting the U.S. Outlook

Geopolitical Tensions

While domestic considerations carry significant weight, global geopolitical events can rapidly alter economic projections. Analysts acknowledge that U.S. relations with strategic partners remain critical for trade, investment, and diplomatic cooperation. Any reemergence of major disputes could unsettle financial markets and strain multinational supply chains, feeding into higher costs for businesses and consumers alike. At the same time, improved diplomatic ties or multilateral trade agreements might open new channels for export-oriented industries, contributing to higher-than-expected growth.

Foreign policy experts also point out that geopolitical risks extend beyond straightforward trade disputes, encompassing currency fluctuations, capital flow restrictions, and intellectual property controversies that resonate strongly in advanced economies. The United States, with a comparatively diversified economy, may be better positioned than smaller nations to absorb external shocks, yet it remains far from immune to disruptions in key sectors such as semiconductors, pharmaceuticals, or heavy machinery.

Technological Disruptions and Cybersecurity

Technological innovation represents a double-edged sword. While it underpins much of the projected productivity gains and economic expansion in 2025, rapid digitalization also heightens vulnerability to cyberattacks, data breaches, and electronic espionage. Leaders in both government and industry view cybersecurity as a top priority, fueling a burgeoning market for advanced security solutions. Nevertheless, a significant cyber incident targeting critical infrastructure or financial institutions could impair consumer and business confidence, unleashing ripple effects across equity and bond markets.

In addition to cybersecurity threats, the relentless pace of innovation can amplify competitive pressures on traditional businesses. Legacy firms that fail to adopt new technologies risk obsolescence as nimbler competitors capture market share. This dynamic can prove disruptive for regions heavily dependent on outdated industries, intensifying calls for policy frameworks that facilitate retraining programs and entrepreneurial support. Overall, effective adaptation to technological change stands as a central challenge for the U.S. economy in 2025, with broad implications for growth, employment, and national security.

Climate and Environmental Factors

Though the role of environmental considerations varies by region and political orientation, climate-related disruptions are an increasingly frequent topic in economic analyses. Severe weather events—such as hurricanes, wildfires, or floods—can lead to substantial economic losses and strain public resources. Economists warn that such episodes may become more frequent or more intense, potentially degrading infrastructure, displacing communities, and interrupting commercial operations. Risk assessments by insurers and large corporations already incorporate climate scenarios, influencing how they price risk, structure supply chains, or locate key facilities.

Meanwhile, shifting consumer and investor preferences for greener solutions continue to spur innovations in clean energy, sustainable agriculture, and electric transportation. On one hand, this transition could drive growth in emerging industries, expand exports, and generate high-quality jobs. On the other, certain legacy sectors might experience reduced demand or face regulatory hurdles that increase costs. Thus, policymakers aiming to enhance economic competitiveness must navigate a complex landscape of environmental initiatives, balancing short-term disruptions with the potential for longer-term gains in resilience and sustainability.

Potential Risks and Uncertainties

Overheating or Stagnation?

Although most forecasts anticipate moderate growth, analysts maintain that economic outcomes for 2025 could diverge markedly from central estimates in the event of unforeseen shocks or policy miscalculations. One possibility is that accommodative fiscal measures and overly loose monetary policy combine to overheat the economy, driving inflation significantly above target and provoking an abrupt tightening of rates. Under such a scenario, businesses could face a credit squeeze, and consumers might reduce discretionary spending, generating a self-reinforcing cycle of slowing growth.

Conversely, excessive caution by policymakers—such as sharp spending cuts or unnecessarily high interest rates—could stifle investment and weaken consumer sentiment. Should capital formation stagnate, productivity gains could slow, resulting in subdued growth prospects and heightened vulnerability to external shocks. Because the U.S. economy is a key driver of global activity, adverse developments within the country could reverberate worldwide, amplifying any downturn.

Policy Impasse and Political Polarization

Another source of risk stems from political polarization or legislative gridlock. If elected officials fail to reach consensus on critical issues—ranging from infrastructure funding to immigration reform—the resulting uncertainty may inhibit long-term planning by businesses. Delayed or inconsistent policy signals can derail investment decisions, particularly in large-scale projects that require stable regulatory environments. Moreover, contentious political battles often capture media attention and shape consumer perceptions of economic stability, either boosting or undermining confidence.

On the flip side, effective policy collaboration could yield significant benefits. A carefully crafted package of measures that address workforce development, technological competitiveness, and sustainable growth might position the U.S. economy to outperform even the more optimistic projections. Thus, the spectrum of possible policy outcomes broadens the range of potential economic paths in 2025, underlining the importance of cohesive action from both the public and private sectors.

Global Financial Market Volatility

Global financial markets, interconnected as never before, can amplify shocks from one region to another in a matter of days or even hours. A sharp economic downturn in a major market—triggered by political upheaval, banking crises, or currency devaluations—could propagate volatility to U.S. equities, bonds, and currencies. Market instability often provokes abrupt reversals in capital flows, affecting businesses reliant on external financing. Additionally, prolonged turmoil could reduce foreign consumer demand for American goods and services, weakening trade balances.

Some economists argue that the prudent regulation of U.S. financial institutions since earlier financial crises has bolstered resilience, making them better equipped to handle global headwinds. Nonetheless, no system is entirely immune to contagion, and vigilance remains necessary to avert sudden liquidity crunches or credit contractions. If widespread financial turbulence were to coincide with domestic inflationary pressures or policy indecision, the resulting uncertainty might intensify the risk of recession.

Looking Ahead: Strategies and Opportunities

Business Planning and Investment

In light of the uncertainties and prospects outlined above, strategic planning by businesses in 2025 encompasses both caution and ambition. Long-term investment decisions are influenced by projections of stable consumer demand, the promise of technological advancements, and the potential for new markets opened by trade agreements. Executives in manufacturing, services, technology, and other sectors typically weigh these opportunities against potential inflation risks, skill shortages, or geopolitical disruptions that might necessitate rapid pivots in supply-chain strategies.

Close collaboration with universities and community colleges has gained momentum as companies seek to ensure a continuous pipeline of skilled workers—ranging from engineers and coders to technicians and customer service representatives. Some large employers also explore creative partnerships with nonprofit organizations and local governments to foster workforce readiness, taking advantage of public grants or tax incentives when available. The overarching theme is that forward-looking business strategies require flexibility, enabling organizations to navigate a landscape where regulatory changes and shifting consumer behaviors can create new winners and losers within short spans of time.

Labor Force Development

As the labor market remains relatively tight in 2025, the need for robust workforce development programs becomes paramount. While automation replaces certain repetitive tasks, industries still rely on skilled human capital to drive innovation, critical thinking, and customer interaction. Some economists stress that labor shortages in specialized fields could hamper growth if employers are unable to fill key positions quickly. Initiatives focusing on retraining, apprenticeships, and flexible career pathways can mitigate these bottlenecks, equipping workers with the in-demand skills required by a rapidly evolving economy.

Moreover, the potential expansion of labor supply through more accommodating immigration policies—if enacted—could help contain wage pressures and alleviate skill gaps in sectors like tech, healthcare, and agriculture. However, debate continues among policymakers and the public regarding the economic, cultural, and national security implications of immigration reform. Ultimately, the direction and scale of these policy changes may prove decisive in determining whether the U.S. labor market can sustain robust productivity gains while keeping inflation manageable.

Technological Leadership

Innovation stands at the heart of the U.S. economic identity, and 2025 is no exception. Policymakers, academic institutions, and corporate research labs remain deeply invested in maintaining the country’s leadership in AI, semiconductors, and other advanced technologies. Competitive advantage in these domains can yield broader economic benefits, from high-paying manufacturing and engineering jobs to lucrative export markets. However, commentators remind stakeholders that preserving such leadership demands consistent funding, regulatory support, and global collaboration. Enabling conditions for innovation often include clear intellectual property protections, seamless data flows, and well-functioning capital markets that reward entrepreneurial risk-taking.

The tech industry’s expansion also carries societal and ethical considerations. Organizations that harness large-scale data analysis must navigate privacy concerns, while those deploying AI-driven solutions grapple with questions of transparency and bias. Although these challenges can be addressed through robust governance frameworks, the complexity of the technologies involved often outpaces the speed of regulatory evolution. Achieving a balance that fosters innovation while safeguarding public interests is likely to remain an ongoing theme in policy discourse well beyond 2025.

Navigating 2025 with Informed Adaptability

Economic projections for the United States in 2025 underscore a blend of guarded optimism and prudent caution. Leading forecasters identify strong consumer demand, technology-driven productivity gains, and careful monetary policy as key supports for continued expansion, even if growth rates gravitate closer to historically modest levels. At the same time, unaddressed structural challenges—such as labor shortages, policy uncertainty, trade tensions, and technology disruptions—carry the potential to unsettle the baseline outlook. In this sense, the U.S. economy retains both remarkable resilience and vulnerability, with outcomes shaped by how effectively businesses, policymakers, and communities respond to evolving conditions.

From a policy standpoint, the federal government’s approach to tax reforms, infrastructure investments, and trade negotiations could tip the scales in favor of either stronger growth or heightened volatility. Likewise, if the Federal Reserve manages to fine-tune its interest rate policy in a way that balances inflation control with support for credit expansion, it may preserve an environment conducive to sustainable gains. At the sector level, industries that embrace transformative technologies and adapt to shifting consumer preferences may outpace those slower to modernize, just as regions offering a skilled workforce and supportive business climates are likely to thrive relative to areas lacking such resources.

Ultimately, the overarching lesson of 2025 is one of adaptability. Rapidly evolving economic conditions, international developments, and policy shifts call for nimble strategies across both the private and public spheres. Businesses that anticipate changes in labor dynamics, cost structures, and market opportunities may capture the benefits of stability even if external disruptions arise. Policymakers who weigh near-term pressures against long-term imperatives—whether in workforce development, fiscal planning, or trade arrangements—stand the best chance of guiding the nation toward balanced growth. While no forecast can fully eliminate uncertainty, understanding the interplay of macroeconomic forces offers a framework for making informed decisions in a landscape where clarity is often elusive.

Readers seeking further insights into current economic trends and future scenarios may consult resources such as Goldman Sachs, Deloitte, Vanguard, OECD, and Trading Economics. These platforms provide additional data on macroeconomic indicators, expert commentary, and real-time market updates, thereby supplementing the perspectives set forth in this discussion of U.S. economic projections for 2025. As the year unfolds, staying abreast of new information, policy changes, and market signals will be essential in making strategic decisions that align with an ever-shifting economic reality.