Inflation, Strategy, and the Next Decade: How Developed-Market Businesses Are Rewriting the Playbook

Inflation has re-emerged as one of the defining forces shaping corporate strategy across developed economies, and by 2026 it is no longer treated as a temporary anomaly but as a structural variable that boards and executive teams must integrate into every major decision. For the global readership of dailybusinesss.com, whose interests span artificial intelligence, finance, crypto, employment, markets, trade, and sustainability across North America, Europe, Asia, Africa, and South America, inflation is no longer a background macroeconomic statistic; it is a daily operational reality that influences pricing power, capital allocation, talent strategies, and long-term competitiveness.

In the wake of the inflationary waves of the early 2020s, organizations in the United States, the United Kingdom, Germany, Canada, Australia, and other advanced economies have moved from reactive cost-cutting toward more sophisticated, data-driven, and technology-enabled frameworks for resilience. Many of the most effective responses blend classical economic understanding with new tools such as AI-driven forecasting, real-time supply-chain visibility, and advanced risk analytics, underscoring how inflation management has become a test of both financial discipline and digital maturity. Readers exploring broader business context on dailybusinesss.com increasingly connect this topic with adjacent themes such as global business trends, financial strategy, investment positioning, and world economic developments.

Inflation in 2026: From Macro Headline to Boardroom Core Metric

By 2026, the conversation in boardrooms from New York and London to Singapore and Frankfurt has shifted from whether inflation will subside to how persistently elevated or volatile price levels should be embedded into strategic planning assumptions. While headline rates have moderated from their peaks in several developed markets, underlying core inflation, sector-specific price spikes, and divergent regional dynamics continue to complicate forecasting. Organizations now routinely track not only consumer price indices but also granular input categories, wage trends, and regional disparities, recognizing that inflation is no longer uniform even within the same currency area.

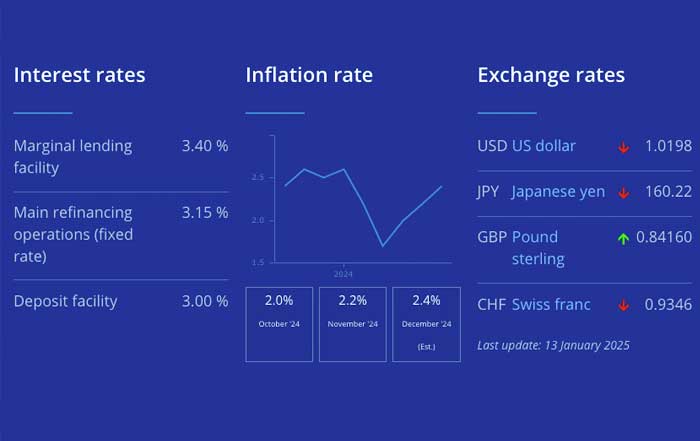

Executives increasingly rely on data from institutions such as the Federal Reserve, the European Central Bank, and the OECD, using their dashboards and commentary as inputs into internal planning rather than definitive guides. Decision-makers monitor how central banks balance inflation control with growth and employment mandates, understanding that monetary policy in the United States, the euro area, the United Kingdom, Japan, and other advanced economies can have powerful spillovers for corporate borrowing costs, asset valuations, and consumer confidence. Those who wish to deepen their understanding of these dynamics often complement institutional sources with independent analysis from platforms such as Learn more about global economic indicators or Review current macroeconomic outlooks.

For readers and clients of dailybusinesss.com, this environment underscores the importance of connecting macroeconomic awareness with micro-level execution. Inflation is no longer an abstract risk factor; it is a lens through which to examine everything from AI-enabled productivity initiatives to crypto's role as a speculative or hedging asset, themes that are explored in more depth in the platform's dedicated sections on AI and technology and crypto and digital assets.

Understanding the New Mechanics of Inflation in Developed Markets

The classical distinction between demand-pull and cost-push inflation remains relevant, but the experience of the 2020s has demonstrated that in globally integrated economies, the boundaries between these categories often blur. Demand surges in one region can collide with supply constraints in another, while geopolitical tensions, energy transitions, and climate-related disruptions add layers of complexity that traditional models only partly capture.

Businesses now pay closer attention to how sector-specific capacity, logistics chokepoints, and regulatory changes propagate through price structures. In Europe, for example, energy price volatility has had a disproportionate impact on manufacturing and heavy industry, while in the United States and Canada, housing and labor market tightness have driven local cost pressures. Firms operating across these jurisdictions must refine their internal analytics to map how input costs and wage dynamics translate into margin pressure, and many have begun to build proprietary indices or dashboards that synthesize public data with internal procurement and payroll information. Executives who wish to benchmark their approach increasingly consult resources such as Explore methodologies for tracking inflation and Understand producer and consumer price indices.

This evolution has elevated the role of in-house economists, data scientists, and finance leaders, who are expected to translate macro trends into actionable guidance for pricing, investment, and resource allocation. For organizations and founders profiled on dailybusinesss.com, the ability to explain inflation mechanics clearly to boards, investors, and employees has become a core component of perceived expertise and trustworthiness.

Central Banks, Interest Rates, and Corporate Strategy

Central banks in the United States, euro area, United Kingdom, Japan, and other advanced economies have spent much of the first half of the 2020s navigating the trade-off between taming inflation and avoiding deep recessions. Their policy paths-rate hikes, balance-sheet adjustments, and forward guidance-have had direct consequences for corporate capital structures, valuation multiples, and strategic horizons.

In 2026, many companies operate under baseline assumptions that interest rates will remain structurally higher than in the ultra-low period that followed the global financial crisis, even if they are now below the 2022-2023 peaks. This re-rating of the cost of capital has profound implications. Growth-at-all-costs models that depended on cheap debt or aggressive equity valuations have given way to more disciplined investment criteria, with finance teams recalibrating hurdle rates and payback expectations. Businesses now scrutinize every major capital expenditure, acquisition, or expansion plan through the lens of interest rate sensitivity, often using scenario analysis informed by sources such as Follow central bank policy communications or Monitor global monetary policy trends.

For the dailybusinesss.com audience interested in markets and trading, this environment has also reshaped portfolio strategies. Investors and corporate treasurers alike weigh the relative attractiveness of fixed income, equities, and alternative assets in an inflation-adjusted framework, emphasizing real returns and diversification. Companies that articulate a coherent interest-rate and inflation strategy in their investor communications tend to command greater confidence, reinforcing the connection between transparency, authority, and market valuation.

Operational Costs, Technology, and Workforce Strategy

Inflation has forced management teams to re-examine their cost bases in far greater detail, particularly in developed markets where labor costs, regulatory compliance, and energy prices are structurally high. Wage pressures, exacerbated by tight labor markets in sectors such as technology, healthcare, logistics, and advanced manufacturing, have compelled businesses to rethink workforce models, benefits structures, and location strategies.

In the United States, United Kingdom, Germany, and other advanced economies, rising expectations around living wages and quality-of-life considerations intersect with inflation to drive compensation upward. Organizations are responding by investing more heavily in skills development, automation, and process redesign to ensure that higher wages are matched by productivity gains. Many are also experimenting with hybrid and remote work models to tap talent pools in lower-cost regions while maintaining access to core markets, a trend that is reshaping employment patterns and is tracked closely in employment and labor market coverage on dailybusinesss.com.

At the same time, inflation has accelerated interest in AI, robotics, and digital platforms as structural cost mitigants. Enterprises across North America, Europe, and Asia are increasingly deploying artificial intelligence for demand forecasting, dynamic pricing, fraud detection, and supply-chain optimization. Technology leaders and policymakers alike recognize that productivity-enhancing innovation can help offset inflationary pressures over the medium term, and readers who wish to examine these developments more closely often refer to resources such as Learn more about AI's impact on productivity or Explore digital transformation case studies.

For companies highlighted on dailybusinesss.com, the credibility of their inflation response is often judged by how coherently they integrate technology investment with human capital strategy. Organizations that communicate clear upskilling plans, transparent automation roadmaps, and responsible AI practices tend to be viewed as more trustworthy by employees, customers, and regulators alike.

Pricing Power, Customer Behavior, and Brand Trust

Inflation's most visible manifestation for consumers is price increases, and in 2026, customer sensitivity to perceived fairness and transparency remains high across the United States, Europe, and Asia-Pacific. Businesses that simply pass through cost increases without clear communication risk reputational damage, regulatory scrutiny, or loss of market share to more disciplined competitors.

Sophisticated firms now combine behavioral insights, data analytics, and brand strategy to calibrate price changes. They analyze elasticity by segment, channel, and geography, adjusting list prices, discount structures, and product configurations with far greater precision than in previous cycles. In markets such as Germany, France, and the Nordics, where consumers are particularly attentive to sustainability and corporate responsibility, companies increasingly link pricing narratives to quality, durability, and environmental performance. Those seeking to refine these approaches often study frameworks from sources like Understand consumer behavior under inflation or Review insights on pricing strategy.

Brand trust has become a critical intangible asset in this context. Companies that have consistently communicated honestly about cost pressures, supply disruptions, and service changes tend to retain loyalty even as prices rise. Conversely, accusations of "greedflation" or opportunistic pricing have led to public backlash and political scrutiny in some markets. For a business-focused platform like dailybusinesss.com, which regularly profiles founders and executives in its founder and leadership coverage, the ability of leaders to articulate a principled approach to pricing is increasingly a marker of long-term reputational strength.

Capital Structure, Hedging, and Investment Discipline

In an environment where inflation and interest rates are both elevated relative to the 2010s, capital structure decisions carry heightened strategic weight. Companies in the United States, United Kingdom, euro area, Japan, and other advanced economies have revisited their mix of fixed versus floating debt, tenor profiles, and currency exposures, often in consultation with global banks and advisors. Treasury teams are more proactive in locking in favorable terms when windows of lower rates appear, while also exploring hedging instruments to manage commodity and FX volatility.

Hedging strategies have become more widespread and more sophisticated, particularly among mid-sized firms that historically lacked the scale or expertise to use derivatives effectively. Businesses with cross-border supply chains or sales footprints in Europe, North America, and Asia now systematically evaluate currency risk and inflation differentials, designing hedging programs that align with their operational realities rather than speculative views. Those looking to deepen their understanding of such practices often refer to Explore corporate risk management practices or Review guidance on derivatives and hedging.

On the equity side, inflation-adjusted valuation discipline has returned to the forefront. Growth projections are scrutinized more rigorously, discount rates incorporate higher risk-free benchmarks, and investors pay closer attention to free cash flow generation and pricing power. For businesses considering initial public offerings or secondary equity raises in markets from New York and London to Frankfurt and Singapore, a credible inflation narrative-covering cost control, pricing strategy, and investment priorities-has become a prerequisite for investor support. These themes intersect closely with the investment and markets analysis that dailybusinesss.com readers follow when assessing opportunities across sectors and geographies.

M&A, Innovation, and Geographic Diversification in an Inflationary Era

Inflation has had a nuanced impact on mergers and acquisitions in developed markets. On one hand, higher financing costs and valuation uncertainty have cooled some deal activity; on the other, strategic acquirers with strong balance sheets have found opportunities to consolidate fragmented industries, secure critical capabilities, or internalize key parts of their supply chains. Boards increasingly evaluate potential targets not only on traditional metrics but also on their inflation resilience: cost structure flexibility, pricing power, geographic diversification, and technology maturity.

Innovation and R&D spending present a similar duality. While inflation puts pressure on discretionary budgets, leading firms in the United States, Europe, and Asia-Pacific recognize that cutting back too aggressively on innovation can leave them structurally disadvantaged when conditions normalize. Many are therefore prioritizing projects that enhance efficiency, reduce resource intensity, or open new high-margin revenue streams, particularly in areas such as clean energy, advanced materials, and digital services. Policymakers in the European Union, United States, and other advanced economies have responded with targeted incentives and grants, which businesses can explore through resources like Learn more about innovation funding programs or Review U.S. innovation and R&D policies.

Geographic diversification has also taken on new meaning. Companies once focused purely on demand growth now weigh inflation profiles, currency stability, regulatory predictability, and geopolitical risk when deciding where to expand. Markets such as Southeast Asia, parts of Eastern Europe, and selected Latin American economies are evaluated not only for their growth potential but also for their role in balancing cost bases and hedging inflation exposure in traditional core markets. For readers of dailybusinesss.com, these developments link closely to coverage of global trade and regional dynamics and world economic shifts, which highlight how corporate footprints are evolving across continents.

Government Policy, Regulation, and Sustainability Under Inflation

Fiscal policy, taxation, wage regulation, and environmental rules all interact with inflation in ways that can either cushion or compound corporate challenges. Governments in the United States, United Kingdom, Germany, Canada, Australia, and other advanced economies have adjusted tax brackets, introduced or expanded targeted subsidies, and debated indexation mechanisms to prevent "bracket creep" from eroding real incomes and profitability. For businesses, these policy shifts require constant monitoring and agile tax planning, often supported by external advisors and informed by references such as Understand international tax developments or Review country-specific fiscal updates.

Minimum wage adjustments and labor protections have also gained prominence as inflation erodes purchasing power, particularly for lower-income workers. Companies with large frontline workforces in retail, hospitality, logistics, and care sectors have had to absorb or offset these increases through productivity improvements, pricing changes, or business model redesigns. While some organizations view such regulations purely as cost drivers, others see them as an opportunity to strengthen employer brands, reduce turnover, and build a more engaged workforce. The employment-focused analysis on dailybusinesss.com reflects this tension, highlighting both the operational complexity and the reputational upside of proactive labour strategies.

Environmental regulation and the broader sustainability agenda remain central despite inflationary pressures. In Europe, North America, and parts of Asia-Pacific, climate policies, emissions standards, and disclosure requirements continue to tighten, even as compliance costs rise. Leaders in sectors such as energy, manufacturing, and transport increasingly recognize that early investment in resource efficiency, renewable energy, and circular-economy models can provide a structural hedge against volatile input prices. Those seeking to deepen their understanding of these themes often consult sources such as Learn more about sustainable business practices or Explore corporate climate disclosure frameworks, while dailybusinesss.com provides ongoing coverage in its sustainability and ESG section.

Digitalization, Crypto, and the Search for Inflation Hedges

The inflationary episodes of the 2020s have also influenced how businesses and investors think about digital assets, tokenization, and decentralized finance. While early narratives positioned cryptocurrencies as straightforward inflation hedges, the volatility of assets such as Bitcoin and Ether relative to traditional inflation measures has complicated that view. Nonetheless, institutional interest in blockchain infrastructure, tokenized real-world assets, and programmable money has grown, particularly in financial centers across the United States, Europe, and Asia.

Central banks have advanced their exploration of central bank digital currencies (CBDCs), which could eventually alter payment systems, liquidity management, and cross-border settlement. Corporates are watching these developments closely, evaluating how digital rails might reduce transaction costs, improve working capital efficiency, or open new business models. For those following this space, resources such as Review central bank digital currency research and Explore digital asset regulatory developments complement the more market-oriented coverage provided in the crypto and digital finance section of dailybusinesss.com.

At the same time, the broader digitalization of finance-real-time payments, embedded finance, AI-driven risk scoring-has enhanced the ability of businesses to manage liquidity under inflationary stress. Dynamic cash forecasting, automated credit control, and integrated treasury platforms help organizations respond more quickly to shifts in rates, spreads, and customer payment behavior. These capabilities, once reserved for large multinationals, are increasingly accessible to mid-sized firms across North America, Europe, and Asia-Pacific, reinforcing the link between digital maturity and financial resilience.

Risk Management, Scenario Planning, and Corporate Governance

By 2026, robust inflation management is widely regarded as a governance issue rather than merely a finance function. Boards in the United States, United Kingdom, Germany, Japan, and beyond now expect management teams to present structured scenario analyses that incorporate different inflation and interest-rate paths, along with associated implications for revenue, margins, balance sheets, and strategic options. These exercises often integrate cross-functional input from operations, HR, technology, and sustainability, reflecting the multi-dimensional nature of inflation risk.

Leading organizations use these scenarios not simply to document risks but to pre-commit to contingent actions: when to adjust pricing, when to trigger cost programs, when to pause or accelerate capital projects, and how to communicate with stakeholders under different macro conditions. External benchmarks and best practices, available through platforms such as Explore enterprise risk management frameworks or Review guidance on board oversight of macro risks, help boards calibrate their expectations and responsibilities.

For the dailybusinesss.com readership, which spans founders, investors, and corporate executives, this shift underscores the importance of embedding inflation awareness into strategy, not treating it as a one-off stress test. Companies that demonstrate disciplined scenario planning, transparent disclosure, and coherent execution are more likely to be perceived as authoritative and trustworthy by capital markets, regulators, and employees alike.

Looking Ahead: Inflation as a Catalyst for Strategic Reinvention

As 2026 progresses, it is increasingly clear that inflation has acted as a stress test for business models across developed economies, exposing weaknesses but also accelerating necessary transformations. Organizations that relied on cheap capital, linear supply chains, and thin margins without pricing power have found the past few years particularly challenging. In contrast, those that invested early in technology, brand strength, human capital, and sustainability have often emerged with stronger competitive positions.

For global readers of dailybusinesss.com, the central lesson is that inflation, while disruptive, can also be a catalyst for strategic reinvention. It forces clarity about value propositions, disciplines capital allocation, and rewards genuine productivity gains over financial engineering. It compels leaders in the United States, Europe, Asia, and beyond to confront structural issues-skills gaps, energy dependence, supply-chain fragility-that might otherwise have been deferred.

In this environment, the most resilient companies are those that integrate macroeconomic insight with operational excellence, digital innovation, and responsible governance. They treat inflation not as a temporary storm to be weathered, but as a persistent condition to be managed with expertise, foresight, and integrity. As dailybusinesss.com continues to cover developments in business and strategy, finance and markets, technology and AI, and global economic trends, the interplay between inflation and corporate strategy will remain a defining theme for leaders navigating the remainder of this decade.