Global Investing in 2026: Strategic Capital Allocation in a Fragmented, AI-Driven World

The global investment landscape in 2026 is defined by a rare combination of structural disruption, geopolitical fragmentation, and rapid technological progress, and for readers of DailyBusinesss, this environment demands a more deliberate, research-driven approach to capital allocation than at any point in the past decade. While growth opportunities remain abundant across asset classes and regions, they are increasingly unevenly distributed, shaped by the interplay between artificial intelligence, shifting trade alliances, evolving demographics, and rising regulatory complexity. Investors who succeed in this context are those who combine macroeconomic awareness with deep sector expertise, build resilient multi-asset portfolios, and ground every decision in robust governance and risk management principles.

A New Macro Reality: Slower Globalization, Faster Digitalization

By 2026, the world economy has moved beyond the emergency policy responses of the early 2020s and into a more nuanced, structurally complex phase. Major central banks in the United States, the euro area, the United Kingdom, Canada, and other advanced economies have largely transitioned from aggressive tightening cycles toward more balanced, data-dependent stances, attempting to preserve disinflation gains without derailing growth. At the same time, fiscal policy remains active in many jurisdictions, particularly in areas such as infrastructure, energy transition, defense, and industrial reshoring, which directly shape the opportunity set for investors.

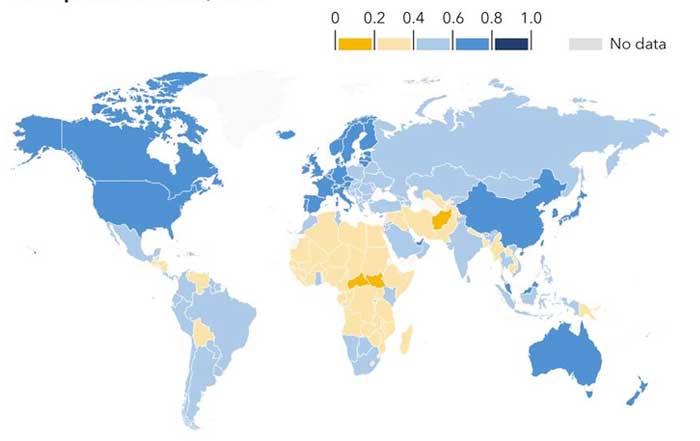

Geopolitical risk continues to influence capital flows and valuation regimes. Tensions between major powers, the reconfiguration of supply chains away from single-country dependence, and a renewed focus on economic security have led to what many analysts describe as "reglobalization" rather than deglobalization: trade and investment are still expanding, but along new corridors, with Asia, the Middle East, and parts of Africa and Latin America playing more prominent roles. Institutions such as the World Trade Organization and OECD provide critical context for understanding how evolving trade rules, subsidies, and standards affect sector competitiveness, particularly in technology, energy, and advanced manufacturing.

For investors following global developments via DailyBusinesss world coverage, this macro backdrop underscores the importance of combining top-down economic analysis with bottom-up assessments of policy risk, regulatory change, and local market depth. The dispersion in growth prospects between regions such as the United States, the euro area, China, India, Southeast Asia, and selected African economies creates both diversification benefits and the need for careful country and currency risk evaluation.

The Central Role of Artificial Intelligence and Advanced Technologies

No theme is reshaping business and investment dynamics in 2026 more profoundly than artificial intelligence. What began as a wave of experimentation with generative AI tools has matured into full-scale integration of AI across finance, healthcare, manufacturing, logistics, marketing, and public services. Organizations ranging from Microsoft and Alphabet to leading industrial groups in Germany, South Korea, and Japan are embedding AI into core workflows, automating routine processes, and reconfiguring value chains.

For readers of DailyBusinesss AI insights, the key investment implication is that AI is no longer a discrete "sector" but a horizontal capability that differentiates winners and losers across virtually every industry. Research by institutions such as the McKinsey Global Institute and World Economic Forum suggests that productivity gains from AI and automation could drive a substantial share of incremental global GDP growth over the coming decade, but these gains will be unevenly captured, favoring firms with superior data assets, engineering talent, and change-management capacity.

In capital markets, this translates into a premium on companies that not only develop AI models but also operationalize them at scale in areas such as supply chain optimization, personalized medicine, algorithmic risk management, and predictive maintenance. Simultaneously, it elevates the importance of cybersecurity, data governance, and regulatory compliance, as policymakers in the United States, the European Union, the United Kingdom, and Asia introduce AI-specific guidelines and enforcement mechanisms. Investors tracking regulatory developments through sources like the European Commission and U.S. Federal Trade Commission gain an edge in assessing compliance costs and potential liability risks.

Beyond AI, other advanced technologies-quantum computing, robotics, advanced semiconductors, synthetic biology, and next-generation communications-are emerging as critical strategic domains. The semiconductor supply chain, spanning the United States, Taiwan, South Korea, Japan, and Europe, has become a focal point for industrial policy and corporate investment, with long-term implications for equity valuations, bond issuance, and cross-border mergers and acquisitions. For investors following DailyBusinesss tech and technology coverage, the message is clear: technology risk is now core business risk, and technology literacy is a prerequisite for credible investment decision-making.

Equity Markets: Selective Growth, Sector Rotation, and Regional Divergence

Global equity markets entering 2026 reflect a decade of digital transformation, post-pandemic realignment, and monetary policy normalization. The United States remains home to many of the world's most valuable public companies, particularly in technology, healthcare, and consumer platforms, but valuation differentials between U.S. equities and those of Europe, Japan, and emerging markets require more discriminating analysis than simple index exposure. Data from organizations such as MSCI and S&P Dow Jones Indices show that sector composition and factor exposures-growth vs. value, quality vs. high beta-are driving performance dispersion at least as much as geography.

For professional investors and sophisticated individuals alike, the equity playbook in 2026 increasingly revolves around three pillars: quality, structural growth, and resilience. Quality is reflected in strong balance sheets, high returns on invested capital, disciplined capital allocation, and robust governance. Structural growth is evident in companies positioned at the intersection of long-term themes such as AI, energy transition, aging populations, digital health, and financial inclusion. Resilience is found in firms with diversified revenue streams, pricing power, and adaptive supply chains able to withstand policy shocks and climate-related disruptions.

Emerging markets remain a critical component of global equity strategies, but the narrative has become more nuanced than a simple "growth vs. developed" dichotomy. Countries such as India, Indonesia, Vietnam, and selected African economies exhibit compelling domestic demand stories, urbanization trends, and digital adoption, while parts of Latin America and the Middle East benefit from resource endowments, infrastructure investment, and fiscal reforms. Institutions like the World Bank and International Monetary Fund provide essential macro context on debt sustainability, institutional quality, and demographic trends that inform country allocation decisions.

At the same time, investors must remain vigilant about concentration risk, particularly in large-cap technology names whose weight in major indices can overshadow other sectors. The experience of the early 2020s, when a handful of mega-cap stocks drove a disproportionate share of index returns, has reinforced the importance of stress testing portfolios against scenarios in which market leadership rotates toward industrials, financials, energy transition plays, or regional champions in Europe and Asia. For readers of DailyBusinesss markets updates, this means complementing passive exposures with targeted active strategies, factor tilts, and thematic allocations.

Fixed Income: From Zero Rates to a More Normal Yield Environment

The fixed-income landscape in 2026 looks markedly different from the era of near-zero interest rates that defined much of the 2010s and early 2020s. Nominal yields in the United States, the United Kingdom, the euro area, and other advanced markets have settled into ranges that provide positive real income in many maturities, albeit with ongoing uncertainty around the path of inflation and policy rates. This normalization has reintroduced bonds as a meaningful source of portfolio yield and diversification, provided investors manage duration, credit, and liquidity risk with care.

Sovereign debt remains the anchor for conservative allocations, but investors increasingly differentiate between issuers with credible fiscal frameworks and those facing rising debt burdens and political fragmentation. Analysis from institutions such as the Bank for International Settlements and national central banks helps investors assess the sustainability of public finances, the risk of policy missteps, and the likelihood of yield curve volatility. In Europe, the evolution of fiscal rules and joint financing mechanisms continues to shape spreads between core and peripheral sovereigns, while in emerging markets, currency risk and external financing conditions remain central considerations.

Corporate credit markets, both investment-grade and high yield, present a complex mix of opportunity and risk. Companies that refinanced at ultra-low rates earlier in the decade face upcoming maturity walls that must be addressed in a higher-rate environment, creating differentiation between firms with strong cash flows and those that relied heavily on cheap leverage. Sector dynamics are also critical: utilities, telecommunications, and healthcare issuers often provide more stable cash flows, while cyclical industries such as consumer discretionary, real estate, and certain industrials require closer scrutiny of balance sheets and competitive position. For investors following DailyBusinesss finance and investment coverage, credit analysis, covenant review, and scenario modeling are indispensable tools.

Sustainable fixed-income instruments-green bonds, social bonds, and sustainability-linked bonds-have moved firmly into the mainstream by 2026. Frameworks from the International Capital Market Association and regulatory initiatives in the European Union and other jurisdictions have improved transparency and reporting standards, though concerns about "greenwashing" persist. Investors seeking to align portfolios with climate and social objectives increasingly demand rigorous use-of-proceeds disclosures, impact metrics, and third-party verification, integrating these instruments into broader ESG-oriented strategies.

Real Assets and Real Estate: Inflation Protection, but Not Uniformly

Real assets-including real estate, infrastructure, and certain commodities-have regained prominence as tools for inflation protection and diversification. However, performance across segments has been highly uneven, reinforcing the need for granular, location-specific and sector-specific analysis. The global real estate market in 2026 is emblematic of this divergence: prime logistics and data center assets in the United States, Europe, and Asia command strong demand and compressed yields, while traditional office portfolios in some central business districts struggle with structural shifts toward hybrid work.

Residential markets present a similarly varied picture. Chronic undersupply in key metropolitan areas in the United States, the United Kingdom, Germany, Canada, and Australia supports rental growth and long-term appreciation potential, but affordability constraints and regulatory interventions-such as rent controls and zoning reforms-shape risk-adjusted returns. In emerging markets, rapid urbanization and the rise of middle-class consumers create demand for modern housing, retail, and mixed-use developments, yet political risk, legal frameworks, and infrastructure quality remain decisive variables.

Real Estate Investment Trusts provide listed exposure to these dynamics, and their performance is increasingly driven by specialization: logistics, healthcare, student housing, manufactured housing, hospitality, and data centers each respond differently to interest rate changes, demographic trends, and technological disruption. For investors following DailyBusinesss business and economics reporting, this reinforces the importance of understanding not only property valuations and cap rates, but also tenant quality, lease structures, and capex requirements, as well as the implications of decarbonization policies and building efficiency standards.

Commodities, Energy Transition, and Strategic Resources

Commodities occupy a dual role in 2026 portfolios: as cyclical assets linked to global growth and as strategic inputs into the energy transition and digital economy. Traditional energy commodities such as oil and natural gas remain integral to global supply, particularly in emerging markets and industrial sectors that cannot yet fully electrify. At the same time, policy commitments under frameworks tracked by organizations like the International Energy Agency and UNFCCC are reshaping long-term demand expectations, capital expenditure plans, and valuation models for fossil fuel producers.

Industrial metals-copper, lithium, nickel, cobalt, and rare earth elements-have taken on heightened importance as enablers of electrification, electric vehicles, grid modernization, and advanced electronics. Supply concentration in a limited number of countries and companies introduces geopolitical and ESG risk, but also creates powerful investment themes around exploration, recycling, substitution technologies, and battery innovation. Gold and other precious metals continue to function as partial hedges against systemic risk, currency debasement, and geopolitical shocks, though their performance is closely tied to real interest rates and the strength of the U.S. dollar.

For investors active in commodities via futures, exchange-traded products, or commodity-linked equities, risk management remains paramount. Volatility driven by weather events, policy changes, sanctions, and technological breakthroughs can be extreme, particularly in agricultural markets and energy. Long-term thematic allocations to energy transition commodities, when combined with careful position sizing and hedging strategies, can complement broader equity and fixed-income holdings, supporting the type of diversified approach regularly discussed in DailyBusinesss investment and markets analysis.

Digital Assets and the Institutionalization of Crypto

By 2026, digital assets occupy a more defined, though still controversial, niche within the global financial system. Bitcoin and Ethereum remain the most systemically significant cryptocurrencies, with a growing ecosystem of regulated exchange-traded products, custody solutions, and derivatives available to institutional and sophisticated retail investors. Regulatory clarity has improved in key jurisdictions, as authorities in the United States, the European Union, the United Kingdom, Singapore, and other financial centers have implemented licensing regimes for exchanges, anti-money-laundering standards, and disclosure requirements.

At the same time, the digital asset universe has become more segmented. Stablecoins, some fully reserved and others operating under stricter prudential rules, play an increasingly important role in global payments and trading settlement. Decentralized finance protocols have evolved, with more emphasis on security audits, insurance mechanisms, and real-world asset tokenization, including tokenized government bonds, real estate, and trade finance receivables. Central bank digital currency pilots and rollouts, tracked by organizations such as the Bank for International Settlements Innovation Hub, have added another layer to the conversation about the future of money and cross-border settlements.

For readers of DailyBusinesss crypto coverage, the central question is no longer whether digital assets will persist, but how they will be integrated into broader portfolios and financial infrastructures. From a risk-return perspective, cryptocurrencies remain highly volatile and speculative, best approached with strict position limits, robust custody practices, and an understanding of protocol-specific risk. However, blockchain technology itself is now deeply embedded in supply chain tracking, trade finance, and digital identity solutions, creating investment opportunities in infrastructure providers, cybersecurity firms, and enterprise software platforms that sit adjacent to, rather than within, the pure crypto space.

Private Markets, Founders, and the Next Generation of Growth Companies

Private equity and venture capital remain central engines of innovation and value creation in 2026, even as they adapt to higher interest rates, tighter liquidity conditions, and more demanding limited partners. Buyout firms have shifted from reliance on leverage toward operational value creation, deploying teams of industry experts, technologists, and data scientists to improve portfolio company performance. Venture capital investors, after a period of exuberant valuations, have become more selective, emphasizing capital efficiency, clear paths to profitability, and defensible intellectual property.

Start-up ecosystems in the United States, the United Kingdom, Germany, France, Canada, Australia, Singapore, India, and parts of Africa and Latin America continue to generate high-potential companies in AI, fintech, climate technology, healthtech, and deep tech. Founders with strong domain expertise, cross-border networks, and the ability to navigate complex regulatory landscapes are particularly sought after. For readers who follow entrepreneurial stories via DailyBusinesss founders section, the alignment between founder vision, investor time horizon, and governance structures is a critical determinant of long-term success.

The illiquid nature of private markets means that allocations must be calibrated carefully within broader portfolios, but for institutions and high-net-worth individuals with sufficient time horizons, these investments can provide differentiated sources of return and exposure to innovation that may not be accessible in public markets. Co-investment opportunities, secondary transactions, and evergreen fund structures have expanded the toolkit for accessing private markets, while also raising the bar for due diligence, legal structuring, and risk oversight.

Sustainability, Regulation, and the Imperative of Trust

Sustainability has moved from a peripheral consideration to a central pillar of corporate strategy and investment analysis. Climate risk, biodiversity loss, social inequality, and governance failures are now recognized as financially material issues by regulators, asset owners, and boards of directors. Disclosure frameworks such as those inspired by the former Task Force on Climate-related Financial Disclosures and evolving standards from the International Sustainability Standards Board are pushing companies toward more consistent reporting on emissions, transition plans, and social impact.

Investors who track sustainable business practices through resources like UN Principles for Responsible Investment and the sustainability-focused reporting on DailyBusinesss sustainable section increasingly integrate ESG analysis into core financial models rather than treating it as a separate overlay. This integration involves assessing physical climate risks to assets, transition risks from policy and technology shifts, human capital strategies in tight labor markets, and governance quality in complex multinational operations. Evidence continues to accumulate that companies with robust ESG practices tend to exhibit lower funding costs, fewer regulatory and reputational shocks, and more resilient earnings profiles over time.

Regulation is reinforcing this trend. Financial supervisors in Europe, North America, and Asia are embedding climate and ESG considerations into stress testing, disclosure rules, and fiduciary duty guidance. Asset managers and owners must demonstrate how they incorporate sustainability into investment processes and stewardship activities, including proxy voting and engagement with portfolio companies. For business leaders and investors alike, this regulatory evolution underscores that trust-grounded in transparency, accountability, and measurable progress-is now a strategic asset.

Employment, Skills, and the Human Dimension of Capital Allocation

Behind every balance sheet and valuation model lies a more fundamental question: how societies manage the transition of labor and skills in an era of automation, demographic change, and shifting economic centers. Organizations such as the International Labour Organization and OECD have highlighted the dual challenge facing advanced and emerging economies: upgrading workforce skills to match AI-enabled, digital roles while ensuring inclusive access to opportunity.

For investors following DailyBusinesss employment coverage, human capital quality is increasingly recognized as a key intangible asset. Companies that invest in continuous learning, reskilling, and supportive work environments tend to adapt more quickly to technological change, maintain higher productivity, and experience lower turnover. Conversely, organizations that underinvest in people may struggle to implement strategic transformations, even when they have access to capital and technology. This human dimension is particularly salient in sectors such as healthcare, education, logistics, and professional services, where people remain central to value creation despite automation.

Strategic Outlook: Building Resilient, Opportunity-Rich Portfolios in 2026

For global investors and business leaders engaging with the analysis on DailyBusinesss, the investment environment of 2026 demands a synthesis of macroeconomic insight, technological fluency, ESG integration, and disciplined risk management. Equities, fixed income, real assets, commodities, digital assets, and private markets all have a role to play, but the weightings, vehicles, and specific exposures must reflect each investor's objectives, constraints, and time horizon.

Diversification across asset classes, regions, sectors, and strategies remains the most reliable defense against uncertainty, yet diversification alone is no longer sufficient. The complexity of today's markets requires active choices about which technologies to back, which regulatory regimes to trust, which management teams to rely on, and which long-term themes-such as AI, energy transition, demographic aging, and digital infrastructure-to emphasize. High-quality information from trusted global institutions, combined with the focused, business-oriented lens provided by platforms like DailyBusinesss business coverage, equips decision-makers to navigate this complexity with greater confidence.

Ultimately, successful capital allocation in 2026 rests on three interlocking principles: clarity of purpose, depth of expertise, and commitment to trust. Clarity of purpose ensures that portfolios are aligned with defined financial goals and risk tolerances. Depth of expertise allows investors to distinguish enduring trends from temporary narratives and to evaluate opportunities with a critical, evidence-based mindset. Commitment to trust-through transparency, ethical behavior, and responsible stewardship-builds the long-term relationships and reputational capital that underpin sustainable success in global markets.

As the world economy continues to evolve, those who combine these principles with a willingness to learn, adapt, and engage with emerging ideas will be best positioned to convert a complex, fragmented landscape into a source of durable value creation for stakeholders in North America, Europe, Asia, Africa, and beyond.