AI Agents in Banking and Payments: How Intelligent Finance Is Redefining 2026

A New Financial Reality for a Data-Driven World

By 2026, artificial intelligence has moved from being a promising experiment to an operational backbone for the global financial system, and nowhere is this more visible than in banking and payments. What began as cautious pilots in risk scoring and fraud detection has evolved into a dense ecosystem of autonomous and semi-autonomous AI agents that analyze markets, converse with customers, route transactions, and support strategic decisions in real time. For the readership of DailyBusinesss.com, spanning executives, founders, investors, policymakers, and technology leaders across North America, Europe, Asia, Africa, and South America, this shift is not an abstract technological trend; it is a structural change that is reshaping how capital flows, how trust is built, and how financial value is created and protected.

AI's rise in finance has coincided with an unprecedented acceleration in digital adoption, cloud computing, and data availability. Major institutions in the United States, the United Kingdom, Germany, Canada, Australia, Singapore, Japan, South Korea, and beyond now treat AI as a strategic capability rather than a peripheral experiment, integrating models directly into credit engines, trading platforms, treasury tools, and customer channels. At the same time, regulators in markets such as the European Union, the United States, and Singapore are formalizing rules for AI governance, algorithmic transparency, and data protection, forcing firms to balance aggressive innovation with demonstrable responsibility. For readers following the broader evolution of technology and business through the technology and AI coverage on DailyBusinesss.com, the financial sector has become one of the clearest case studies of how Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) determine which players will lead and which will be left behind.

The new reality is that AI agents now sit at the heart of end-to-end financial journeys: onboarding and identity verification, personalized product design, real-time payments, dynamic credit management, and post-trade compliance. These agents are increasingly multimodal, drawing on transaction histories, open banking feeds, behavioral signals, market data, and even geospatial and IoT inputs to make contextual decisions. The leaders in this transformation are not only global banks and payment networks, but also specialized fintechs, cloud hyperscalers, and AI research companies such as OpenAI and Anthropic, whose platforms underpin many of the conversational and analytical systems in production today. For businesses, investors, and policymakers tracking global markets and investment trends via DailyBusinesss.com/markets and DailyBusinesss.com/investment, understanding how these AI agents operate has become essential to evaluating risk, opportunity, and long-term competitiveness.

From Experimental Tools to Core Financial Infrastructure

In historical terms, AI's journey in finance reflects a gradual but decisive transition from narrow automation to strategic intelligence. Early deployments in the 2000s and early 2010s focused on rule-based fraud detection and basic credit scoring, with limited autonomy and modest impact on customer experience. The real inflection point came in the late 2010s and early 2020s, when advances in deep learning, natural language processing, and cloud infrastructure converged with the rise of open banking and API-first architectures. Institutions could suddenly ingest and analyze enormous volumes of structured and unstructured data, while new entrants leveraged this capability to build highly targeted products in lending, wealth management, and payments.

By the mid-2020s, and especially into 2026, AI is no longer confined to isolated use cases. It functions as a horizontal capability across the value chain, shaping how banks allocate capital, price risk, detect anomalies, and communicate with customers. Leading regulators, such as the European Central Bank and the Bank of England, have published supervisory expectations on model risk management and AI transparency, while organizations like the Financial Stability Board and the Bank for International Settlements continue to assess systemic implications of machine-driven decision-making. Readers seeking to understand the macroeconomic and regulatory context can explore broader economics and finance perspectives on DailyBusinesss.com/economics and DailyBusinesss.com/finance, where AI is increasingly discussed as a factor in productivity, competition, and financial stability.

The maturation of AI in finance has also been driven by collaboration. Large banks in the United States, Europe, and Asia-Pacific now routinely partner with specialist fintechs, AI labs, and cloud providers to accelerate deployment, while venture investors continue to fund startups in AI-native underwriting, autonomous treasury, and embedded finance. This interplay between incumbents and disruptors is reshaping competitive dynamics in markets from New York and London to Singapore and São Paulo, creating new ecosystems that blend financial expertise with cutting-edge machine intelligence.

AI Agents as the New Front Line of Customer Experience

One of the most visible manifestations of AI in 2026 is the rise of conversational and advisory agents that operate across mobile apps, web platforms, messaging channels, and voice interfaces. These agents do far more than answer simple balance queries; they analyze transaction histories, categorize spending, infer life events, and cross-reference real-time market data to provide context-aware guidance on saving, borrowing, and investing. For example, a customer in Canada or Germany might receive a proactive alert that their discretionary spending is trending above usual levels just before a known recurring expense, accompanied by personalized suggestions to adjust transfers or modify card usage, while a small business owner in Singapore could be notified of a projected cash flow shortfall weeks in advance, with tailored recommendations for short-term credit options.

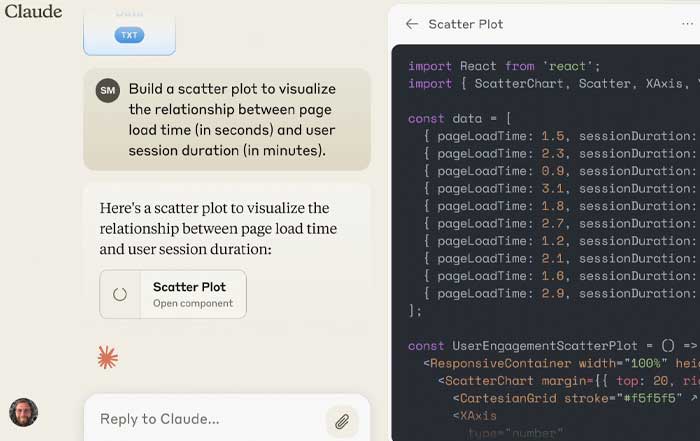

Modern AI assistants are built on large language models and retrieval systems similar to those offered by OpenAI and other leading research organizations, but they are tightly constrained by bank-grade security, domain-specific knowledge, and rigorous compliance controls. Institutions invest heavily in prompt engineering, guardrail systems, and human-in-the-loop workflows to ensure that recommendations are not only accurate, but also aligned with regulatory requirements and internal risk appetites. For readers following the evolution of conversational interfaces and digital channels through the tech and business sections of DailyBusinesss.com/tech and DailyBusinesss.com/business, these AI agents exemplify how user experience, trust, and regulatory scrutiny intersect in high-stakes environments.

Critically, many leading banks and payment providers have adopted a hybrid model in which AI handles routine and mid-complexity interactions, while seamlessly escalating edge cases or emotionally sensitive issues to human specialists. This orchestration is itself guided by AI, which can detect confusion, frustration, or uncertainty in a customer's language and route the conversation accordingly. The result is a service model that combines the scalability and 24/7 availability of machines with the empathy and judgment of experienced professionals, aligning with the E-E-A-T principles that increasingly underpin both regulatory expectations and customer trust.

Security, Fraud, and the Arms Race with Adversaries

As digital transaction volumes surge across regions from the United States and Europe to Southeast Asia and Africa, the threat landscape has expanded in both sophistication and scale. Traditional rule-based systems struggle to keep pace with novel fraud vectors, synthetic identities, and coordinated attacks that exploit minor gaps in verification flows. AI agents, particularly those based on anomaly detection and graph analytics, have become indispensable in this environment, continuously scanning transaction streams, device fingerprints, behavioral biometrics, and network patterns to flag suspicious activity in milliseconds.

Institutions now combine supervised and unsupervised models to detect both known and emerging fraud typologies, while layered defenses incorporate device intelligence, geolocation, IP reputation, and behavioral signals such as typing cadence or navigation patterns. Biometric authentication, including face and voice recognition, has been enhanced by AI that can detect presentation attacks and deepfakes, a growing concern as generative technologies become more accessible. Organizations such as ENISA in Europe and the Cybersecurity and Infrastructure Security Agency in the United States provide guidance on best practices for securing digital financial infrastructures, and industry groups collaborate on shared intelligence to respond quickly to cross-border fraud campaigns.

At the same time, AI is being used defensively within institutions to monitor privileged access, detect anomalous employee behavior, and identify potential data exfiltration. Security operations centers now deploy AI copilots to triage alerts, correlate signals across systems, and recommend response playbooks, improving both speed and consistency of incident handling. For businesses and founders tracking operational risk and cyber resilience through the world and news coverage on DailyBusinesss.com/world and DailyBusinesss.com/news, the message is clear: AI is no longer optional in cybersecurity; it is a core requirement for defending high-value financial targets in a world of increasingly capable adversaries.

Invisible Automation: AI in the Financial Back Office

While customer-facing applications attract the most attention, some of the most significant productivity gains from AI have emerged behind the scenes, in the operational core of banks and payment companies. Intelligent document processing systems now extract, classify, and validate information from loan applications, KYC files, trade documents, and regulatory submissions with far greater accuracy and speed than human teams. AI-enhanced robotic process automation orchestrates complex workflows across legacy systems, reducing manual handoffs, errors, and delays.

In credit, treasury, and risk management, AI models continuously ingest internal and external data-ranging from transaction histories and payment performance to macroeconomic indicators and market volatility-to update risk scores, adjust limits, and support capital allocation decisions. For institutions operating across multiple geographies, this dynamic view of risk is essential in a world shaped by persistent inflation pressures, geopolitical tensions, and evolving monetary policy. Organizations such as the International Monetary Fund and the World Bank provide macroeconomic context that increasingly feeds into these models, while central banks and supervisors refine stress-testing frameworks to account for AI-driven behaviors and feedback loops.

Regulatory reporting and compliance have also been transformed. AI systems map regulatory requirements to data fields, monitor changes in rules across jurisdictions, and generate draft reports that compliance teams review rather than build from scratch. Natural language processing helps interpret new guidelines and consultation papers, flagging areas where internal policies or systems may need adjustment. For readers who follow trade, employment, and economics policy debates via DailyBusinesss.com/trade and DailyBusinesss.com/employment, this automation has implications for workforce composition, skill requirements, and the future of regulatory oversight.

The net effect of these back-office advances is a structural shift in how financial institutions deploy human capital. Routine, rules-based tasks are increasingly handled by machines, while human professionals focus on complex judgment calls, relationship management, product design, and oversight of AI systems themselves. This transition is far from trivial; it requires significant investment in reskilling and change management, as well as new roles in model governance, AI ethics, and human-machine interaction design.

Real-Time, Personalized, and Borderless Payments

In payments, AI has accelerated three reinforcing trends that are particularly relevant to the global audience of DailyBusinesss.com: the rise of real-time rails, the deep personalization of payment experiences, and the ongoing reinvention of cross-border transfers.

Real-time payment infrastructures, from the FedNow Service in the United States to SEPA Instant Credit Transfer in Europe and fast payment systems in markets like Singapore, India, and Brazil, have created the technical foundation for instant settlement. AI agents sit on top of these rails to handle risk checks, fraud screening, sanctions screening, and liquidity management in real time, ensuring that speed does not come at the expense of security or regulatory compliance. For merchants and platforms in sectors such as e-commerce, travel, and gig work, this combination of immediate settlement and intelligent risk control supports new business models, including instant payouts and dynamic pricing.

Personalization has transformed payment apps from passive utilities into financial companions. AI analyzes spending patterns, subscription usage, travel behavior, and even carbon footprints to deliver tailored insights, offers, and nudges. Users in the United Kingdom, France, Italy, Spain, the Netherlands, and other European markets now frequently see dynamic recommendations for optimizing card usage, switching to lower-fee payment methods, or aligning spending with sustainability goals, reflecting growing interest in sustainable business practices. In some markets, AI-driven payment platforms integrate seamlessly with investment and savings tools, automatically rounding up purchases into micro-investments or adjusting savings rates based on projected cash flows.

Cross-border payments, historically characterized by opaque fees and long settlement times, have been a focal point for AI- and blockchain-enabled innovation. AI agents now optimize FX execution, route payments through the most efficient corridors, and provide end-to-end tracking that resembles parcel delivery visibility rather than traditional correspondent banking opacity. Distributed ledger experiments, including those led by the Bank for International Settlements Innovation Hub and various central bank digital currency (CBDC) pilots, often rely on AI to manage liquidity, monitor compliance, and analyze transaction patterns. For founders and investors exploring crypto and digital asset infrastructure through DailyBusinesss.com/crypto, these developments illustrate how AI is central to making blockchain-based systems usable, compliant, and scalable in mainstream finance.

Convergence with Blockchain, IoT, and Emerging Compute

The most advanced financial institutions in North America, Europe, and Asia are no longer thinking about AI in isolation; they are designing architectures that combine AI with blockchain, the Internet of Things, and, increasingly, quantum and quantum-inspired computing. On permissioned blockchains and distributed ledgers, AI agents analyze network activity to detect anomalies, optimize smart contract execution, and manage network congestion, while the immutable nature of the ledger provides rich, auditable data for training and validation. This convergence is particularly relevant in trade finance, supply chain finance, and tokenized asset markets, where multiple parties need a shared view of transactions and collateral.

IoT data, from connected vehicles, industrial equipment, and consumer wearables, is feeding new models for risk assessment, insurance pricing, and contextual payments. AI systems that can handle high-velocity, high-volume streaming data are increasingly important, especially in regions like Germany, Sweden, Norway, Japan, and South Korea, where industrial IoT adoption is advanced. For example, usage-based insurance products in Europe and North America rely on AI to interpret driving patterns, while embedded finance solutions in logistics and manufacturing use sensor data to trigger automated payments or credit line adjustments when specific operational thresholds are met.

Although large-scale quantum computing is not yet mainstream in commercial finance, leading institutions and research centers are experimenting with quantum-inspired algorithms for portfolio optimization, option pricing, and complex risk simulations. These approaches, influenced by work from organizations such as IBM, Google, and major academic labs, aim to give AI models access to richer scenario sets and more efficient search capabilities, even when running on classical hardware. For executives and investors tracking the frontier of technology and future trends through DailyBusinesss.com/technology, these experiments are early indicators of how compute paradigms may evolve over the coming decade.

Ethics, Governance, and the New Standard of Trust

As AI agents gain influence over who receives credit, how transactions are monitored, and how financial advice is delivered, questions of ethics, fairness, and accountability have become central. Regulators in the European Union, for example, are finalizing the EU AI Act, which classifies credit scoring and other financial applications as high-risk and mandates strict requirements for transparency, data quality, and human oversight. In the United States, agencies such as the Consumer Financial Protection Bureau and the Federal Trade Commission have signaled that existing consumer protection and anti-discrimination laws apply fully to algorithmic decision-making, while jurisdictions like Singapore and the United Kingdom have published model AI governance frameworks and guidance on responsible use.

Financial institutions are responding by implementing end-to-end AI governance structures that cover data sourcing, model development, validation, deployment, and monitoring. Dedicated AI risk committees, ethics boards, and cross-functional model governance teams are becoming standard, particularly among systemically important banks and large payment networks. Techniques such as explainable AI, bias detection, and counterfactual testing are used to ensure that models do not systematically disadvantage protected groups or produce outcomes that cannot be justified to customers or regulators. For readers interested in the intersection of law, policy, and business strategy, these governance frameworks represent a new layer of competitive differentiation: firms that can demonstrate robust, auditable AI practices are better positioned to win institutional clients, secure regulatory approvals, and maintain public trust.

Data privacy and security remain foundational. Regulations such as the GDPR in Europe, the California Consumer Privacy Act in the United States, and emerging data protection laws in markets like Brazil, South Africa, and Thailand constrain how financial institutions collect, process, and share personal data. AI systems must be designed with privacy by default, incorporating techniques such as data minimization, anonymization, and, in some cases, federated learning to reduce the need for centralized storage of sensitive information. For global organizations, managing this mosaic of rules requires sophisticated policy engines and AI-enabled compliance tools that can adapt workflows in real time based on jurisdiction, product, and customer segment.

Bias and accessibility are equally critical. AI has the potential to expand financial inclusion by using alternative data-such as utility payments, rental histories, or mobile usage patterns-to underwrite customers with thin or no traditional credit files, particularly in emerging markets across Africa, South Asia, and Latin America. However, if not carefully designed, these models can entrench existing inequalities or create new forms of exclusion. Leading institutions are therefore investing in inclusive design, multilingual interfaces, and accessible channels that support users with varying levels of digital literacy and physical ability. For founders and leaders building the next generation of financial platforms, many of whom follow entrepreneurship insights on DailyBusinesss.com/founders, this focus on fairness and accessibility is not only a regulatory necessity, but also a source of long-term growth in underserved segments.

Autonomous, Predictive, and Embedded Finance: What Comes Next

Looking beyond 2026, the trajectory points toward increasingly autonomous, predictive, and embedded financial experiences. Predictive banking, already visible in early deployments, will become more granular and anticipatory as models integrate broader datasets, from labor market indicators and housing prices to climate risks and geopolitical developments. Conversational AI will continue to evolve toward richer, multi-turn financial coaching that feels less like a scripted assistant and more like an always-available relationship manager, powered by models that can reason over complex portfolios and regulatory constraints.

Autonomous financial management, where AI agents execute decisions within guardrails defined by customers or corporate treasurers, is likely to expand in both retail and institutional segments. In practice, this could mean AI-managed savings strategies, automated rebalancing across crypto and traditional assets, dynamic hedging of FX exposures, or fully automated working capital optimization for SMEs. Embedded finance, where banking and payment capabilities are integrated directly into non-financial platforms-from travel and mobility apps to B2B marketplaces and creator platforms-will increasingly rely on AI agents operating behind the scenes to assess risk, price products, and manage compliance in real time.

For the global audience of DailyBusinesss.com, spanning sectors from finance and crypto to travel and trade, the implications are profound. The boundaries between financial services and other industries will continue to blur, with AI acting as the connective tissue that enables safe, personalized, and context-aware financial interactions wherever customers are-on their phones in New York or Lagos, in a factory in Germany or Vietnam, or on a business trip between London and Singapore. Institutions that combine deep domain expertise with mature AI capabilities, rigorous governance, and a clear commitment to customer outcomes will define the next chapter of global finance.

In that context, the role of independent, analytically rigorous platforms such as DailyBusinesss.com is to help decision-makers navigate this complexity: to distinguish signal from noise, to highlight credible practices and emerging risks, and to provide a cross-regional, cross-sector view of how AI is reshaping money, markets, and economic opportunity. As AI agents become ever more embedded in banking and payments, the core questions for leaders are no longer whether to adopt these technologies, but how to do so in a way that strengthens resilience, broadens inclusion, and builds a more transparent and trustworthy financial system for the decade ahead.