Digital Marketing in 2026: How Technology, Trust, and Talent Are Redefining Growth

Digital marketing in 2026 is no longer a specialist discipline sitting on the edge of business strategy; it has become the connective tissue that links product, technology, finance, operations, and customer experience. For the global audience of DailyBusinesss.com, spanning executives, founders, investors, and policy leaders from North America, Europe, Asia, Africa, and South America, understanding this evolution is now a prerequisite for competitive advantage. The convergence of artificial intelligence, real-time data, automation, immersive technologies, and stricter regulatory oversight has created a marketing environment that is both more powerful and more demanding than anything seen in the previous decade. The organizations that are winning in this environment are those that combine deep technical capability with disciplined governance and a clear commitment to ethical, customer-centric growth.

From Media Buying to Experience Design

In the early 2010s, marketing success was still heavily associated with media buying power across television, print, and outdoor channels. By 2026, the center of gravity has shifted decisively toward orchestrating end-to-end customer experiences across digital ecosystems. Marketing leaders no longer limit their remit to campaigns and creative assets; they influence product roadmaps, pricing strategies, channel partnerships, and even the structure of corporate data platforms. For readers who follow broader business transformation trends on DailyBusinesss Business, this shift aligns with the move from function-centric to journey-centric operating models seen across leading enterprises.

The rise of always-on connectivity, 5G and emerging 6G trials, cloud-native applications, and mobile-first behavior has made "being online" a continuous default state for consumers across the United States, Europe, and major Asian markets such as China, Japan, South Korea, and Singapore. As a result, the marketing discipline has had to evolve from periodic, campaign-based communication to continuous, context-aware interaction. This evolution is particularly visible in markets with high smartphone penetration and advanced digital payment infrastructure, where consumers expect frictionless, personalized experiences whether they are browsing, buying, or seeking support.

For global brands, this shift has also demanded a more nuanced understanding of regional differences. While consumers in Germany, France, and the Netherlands may prioritize data privacy and transparent value exchange, audiences in Brazil, Thailand, South Africa, and Malaysia often respond more strongly to mobile-first, social commerce experiences that blend entertainment, community, and convenience. The ability to localize digital journeys at scale, without fragmenting the core brand narrative, has become a key differentiator and a recurring theme in strategic discussions across boardrooms and investment committees, as reflected in coverage on DailyBusinesss World.

Data, AI, and the New Marketing Operating System

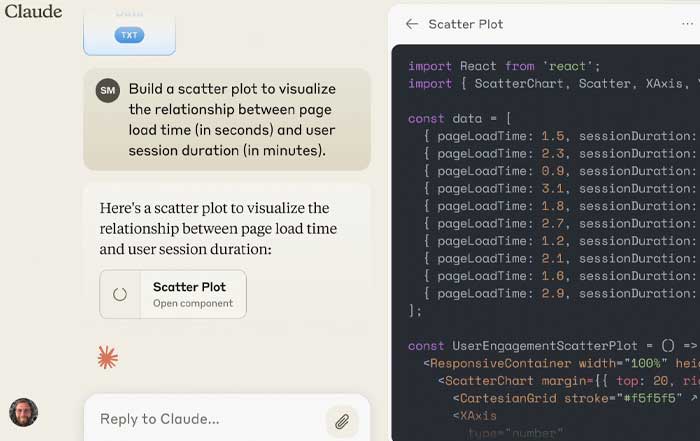

By 2026, marketing is fundamentally data infrastructure plus decision intelligence plus creative execution. The raw materials of this system are behavioral, transactional, and contextual data points flowing from websites, apps, connected devices, payment platforms, and third-party signals. The processing engine increasingly consists of AI models, from predictive analytics to large language models and recommendation systems. The output is a portfolio of micro-experiences: personalized messages, dynamic prices, tailored offers, adaptive content, and optimized journeys.

Leading organizations have built integrated data platforms that combine customer data platforms (CDPs), data lakes, and real-time event streams. These platforms are often underpinned by cloud providers such as Amazon Web Services, Microsoft Azure, or Google Cloud, each offering specialized tools for analytics, AI, and marketing integration. Executives and CMOs who wish to deepen their understanding of how to architect such environments frequently turn to resources like the Google Marketing Platform to explore how analytics, tagging, and media buying can be unified into a single measurement and optimization framework.

Artificial intelligence now plays a central role in this operating system. Recommendation engines similar to those used by Netflix or Amazon have become standard in e-commerce, financial services, and content platforms, using historical behavior and lookalike modeling to anticipate what each individual is most likely to value next. Predictive models help marketing and finance teams, including those focused on DailyBusinesss Finance, forecast customer lifetime value, churn risk, and cross-sell potential, bringing marketing metrics closer to the language of cash flows, margins, and return on invested capital. This alignment has strengthened marketing's influence in capital allocation decisions, especially in publicly listed companies and late-stage growth ventures.

Real-time analytics has also become a strategic asset. Dashboards now track not only impressions and clicks but also incremental revenue, contribution margin, and cohort retention curves. Organizations that once waited for monthly performance reports now rely on streaming analytics platforms that surface anomalies, opportunities, and risks within minutes. Tools from providers such as Adobe Experience Cloud and Salesforce Marketing Cloud allow teams to adjust creative assets, bidding strategies, and audience definitions in near real time. For decision-makers, learning how to interpret these signals and act without overreacting is now a core leadership competency, comparable to reading a balance sheet or an income statement.

Social, Community, and the New Trust Economy

Social media has matured from a set of communication channels into a complex trust economy in which attention, credibility, and community are traded alongside products and services. In 2026, marketing leaders treat social ecosystems less as advertising networks and more as living markets of ideas, identities, and relationships. The most sophisticated brands operate integrated social strategies that span short-form video, messaging apps, professional networks, live audio, and creator platforms, tailoring their approaches for distinct audiences in the United States, United Kingdom, Canada, Australia, and across Europe and Asia.

Influencer and creator partnerships have become more structured and measurable. Instead of ad hoc collaborations, enterprises now deploy frameworks that classify creators by reach, relevance, resonance, and risk. They negotiate contracts that specify content rights, disclosure standards, and performance metrics, and they use specialized platforms to track engagement, sentiment, and conversion. Regulatory bodies such as the Federal Trade Commission in the United States and the Competition and Markets Authority in the United Kingdom have reinforced disclosure requirements, pushing brands and creators to be explicit when content is sponsored. Executives seeking to understand these rules in detail often consult resources such as the FTC's Endorsement Guides to ensure compliance and protect brand equity.

The rise of social commerce has further blurred the lines between content and transaction. Integrated shopping features within major platforms allow users to move from discovery to purchase in a few taps, supported by embedded payments and logistics integrations. For retailers and direct-to-consumer brands, this has created a powerful new revenue stream but also a dependency on algorithm-driven environments that can change rapidly. Marketers hedge this risk by building robust first-party channels-websites, apps, email, and SMS-where they control data, messaging, and customer relationships. The tension between platform dependency and owned-channel resilience is now a central strategic question for digital leaders around the world.

Social listening and sentiment analysis have also reached a new level of sophistication. AI-powered tools scan billions of posts and comments to detect emerging trends, brand mentions, and reputational risks, often before they surface in mainstream media. When combined with data on sales, churn, and support interactions, these signals allow marketing and communications teams to move from reactive crisis management to proactive reputation stewardship. For leaders who monitor macroeconomic and political risk via sources such as Reuters or the BBC, integrating social sentiment into scenario planning has become an essential component of enterprise risk management.

Personalization, CX, and the Economics of Loyalty

Personalization in 2026 is no longer limited to first-name email greetings or basic product recommendations. It now encompasses dynamic content, adaptive pricing, tailored service levels, and context-aware journeys that differ by geography, device, and intent. The most advanced organizations view personalization as a profit-and-loss lever rather than a user-interface enhancement, rigorously testing its impact on acquisition costs, average order value, retention, and referral behavior. This financial discipline resonates strongly with investors and analysts who follow DailyBusinesss Investment and DailyBusinesss Markets, where valuation increasingly depends on sustainable, high-quality growth rather than short-term spikes in traffic.

Customer experience management has become deeply cross-functional. Marketing, product, operations, and customer support teams collaborate to design journeys that feel coherent regardless of touchpoint-online, in-app, in-store, or through partners. This is particularly important in service-heavy industries such as banking, insurance, healthcare, and travel, where trust and reliability are critical. Organizations benchmark their CX performance using widely recognized frameworks, and many reference independent research such as the Forrester Customer Experience Index to understand how they compare with peers in their region or sector.

Loyalty programs have also undergone a structural transformation. Traditional points-based schemes are being augmented or replaced by tiered memberships, experiential rewards, and, in some cases, blockchain-enabled tokens that can be used across partner ecosystems. While the initial wave of speculative crypto enthusiasm has cooled, serious enterprises continue to experiment with tokenized loyalty and digital collectibles as mechanisms to deepen engagement, particularly among younger, digitally native consumers. Readers who track digital asset developments on DailyBusinesss Crypto will recognize that the most credible initiatives are those that prioritize utility, interoperability, and regulatory compliance over hype.

The economics of loyalty are increasingly quantified at the board level. Companies model the incremental cash flows associated with higher retention and cross-sell rates, comparing these with the costs of personalization technology, rewards, and enhanced service levels. In markets such as Sweden, Norway, Denmark, and Finland, where digital adoption is high and competition intense, this analytical approach to loyalty has become a core element of strategic planning. In emerging markets across Africa and South America, where digital penetration is rising quickly, firms are adapting these models to local purchasing power, infrastructure constraints, and cultural expectations.

Automation, Platforms, and the Future of Marketing Work

Marketing automation has moved from being a tactical efficiency tool to a strategic backbone that shapes how teams are structured, how campaigns are executed, and how performance is governed. Email sequences, lead nurturing flows, retargeting journeys, and customer lifecycle programs now run on sophisticated orchestration platforms that blend rule-based logic with AI-driven optimization. Platforms such as HubSpot, Salesforce, and Oracle have expanded their capabilities to cover everything from lead scoring and attribution modeling to content management and sales enablement. Professionals looking to deepen their technical skills often turn to vendor academies and open education resources like Coursera to stay current with platform capabilities and best practices.

Automation has also reshaped the skills profile of marketing teams. Routine tasks such as list segmentation, basic reporting, and simple creative variants are increasingly handled by software, freeing human talent to focus on strategy, insight generation, brand positioning, and complex creative development. At the same time, demand has surged for hybrid profiles-marketers who can interpret data, understand AI outputs, collaborate with engineers, and still think in terms of narrative, emotion, and brand equity. This shift is particularly relevant for readers of DailyBusinesss Employment, as it affects hiring patterns, training investments, and career trajectories across global markets.

For founders and growth-stage companies, platform selection has become a critical early decision. Choosing tools that can scale from a few thousand to several million customers, integrate with existing finance and product systems, and comply with data residency rules in regions such as the European Union can significantly reduce technical debt. Many entrepreneurs and investors who follow DailyBusinesss Founders now treat marketing technology architecture as a board-level topic, recognizing that poor early choices can constrain international expansion, partnership opportunities, and exit valuations.

The future of marketing work is also being shaped by generative AI. Large language models and image-generation systems are increasingly used to draft copy, propose creative concepts, localize campaigns across languages, and generate variations for testing. While leading organizations maintain strict human oversight, they are already seeing productivity gains in areas such as A/B testing, SEO content, and social media ideation. Thoughtful leaders reference guidelines from organizations such as the World Economic Forum on responsible AI deployment to ensure that automation enhances human creativity rather than eroding trust or quality.

Privacy, Regulation, and Ethical Guardrails

As data volumes and AI capabilities grow, so do regulatory scrutiny and public expectations around privacy, fairness, and transparency. In 2026, marketing leaders must navigate a complex patchwork of regulations, including the EU's GDPR, the California Consumer Privacy Act, and a range of national and regional laws across Asia-Pacific, Latin America, and Africa. Multinational organizations increasingly design their policies and systems to meet the strictest common denominator, both to minimize compliance risk and to signal a commitment to responsible data stewardship.

Independent authorities and standards bodies have become influential in shaping best practices. The European Data Protection Board and national data protection authorities regularly publish guidance on topics such as consent, profiling, and cross-border data transfers. Many executives consult resources like the European Data Protection Supervisor or the UK Information Commissioner's Office to interpret evolving expectations and adapt their marketing practices accordingly. Across Switzerland, Netherlands, and other European markets, these guidelines strongly influence how personalization, retargeting, and AI-driven segmentation are implemented.

Ethical AI has moved from academic discussion to operational reality. Organizations now conduct bias audits on their recommendation engines, targeting models, and automated decision systems to ensure that they do not systematically disadvantage specific demographic groups. Industry groups and think tanks such as the OECD AI Observatory and IEEE have published frameworks for trustworthy AI, encouraging companies to consider fairness, accountability, transparency, and human oversight as core design principles. For marketing leaders, this means collaborating more closely with data scientists, legal teams, and external auditors to align growth ambitions with societal expectations.

Security and brand safety also remain central concerns. The growth of programmatic advertising has brought efficiency but also exposure to fraudulent inventory, unsafe content, and reputational risk. To mitigate these threats, brands deploy verification tools, use curated marketplaces, and set strict inclusion and exclusion criteria for ad placements. Industry initiatives supported by organizations such as the Interactive Advertising Bureau and Trustworthy Accountability Group have helped establish standards, but ultimate responsibility still rests with the brand and its agencies.

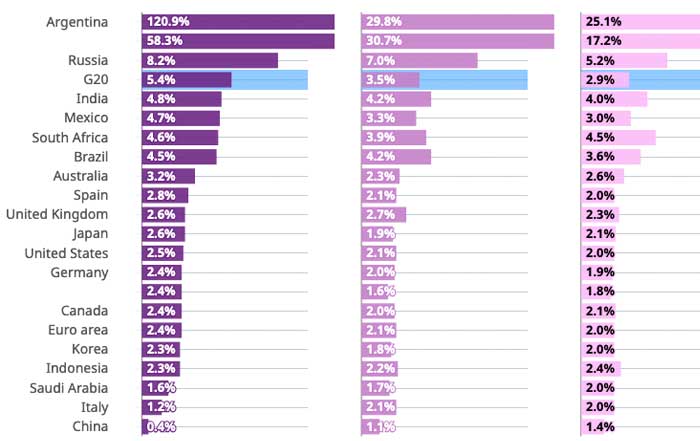

For the readers of DailyBusinesss Economics, the regulatory evolution has broader macroeconomic implications. Data governance and AI rules influence which regions become hubs for digital innovation, how cross-border digital trade is structured, and how competitive dynamics evolve between incumbents and challengers. Countries that strike the right balance between innovation and protection are better positioned to attract investment, talent, and high-value digital industries.

Immersive, Sustainable, and Borderless: The Next Frontier

Immersive technologies such as augmented reality, virtual reality, and persistent virtual environments continue to evolve, even if the initial hype around the "metaverse" has moderated. In 2026, the most effective use cases are pragmatic rather than speculative: AR try-ons for fashion and beauty, VR simulations for travel and real estate, 3D product configurators for automotive and industrial equipment, and collaborative virtual spaces for training and B2B sales. These experiences are increasingly integrated into broader omnichannel journeys, rather than existing as standalone experiments. Travel and hospitality brands, for example, use VR previews to inspire intent and then retarget engaged viewers with tailored offers via mobile and email, a pattern that aligns with trends covered on DailyBusinesss Travel.

Sustainability has also become a powerful lens through which marketing strategies are evaluated. Stakeholders-from consumers and employees to regulators and institutional investors-expect brands to provide credible, verifiable information on their environmental and social impact. This expectation has reshaped messaging, product development, and supply chain transparency. Companies now use digital channels to share lifecycle analyses, sourcing data, and progress against climate targets, often referencing independent standards from organizations like the UN Global Compact or the Science Based Targets initiative. For readers of DailyBusinesss Sustainable, this convergence of ESG priorities and digital communication is a defining feature of modern brand leadership.

Borderless digital trade is another frontier reshaping marketing. Cross-border e-commerce, remote service delivery, and globally distributed workforces have made it easier for even small and mid-sized companies to reach customers in multiple regions. At the same time, they must navigate diverse tax regimes, cultural norms, content regulations, and payment preferences. Institutions such as the World Trade Organization and regional blocs like the European Union are actively debating frameworks for digital trade, data flows, and platform governance. Marketers operating in this environment must be as comfortable discussing customs codes and local payment options as they are analyzing click-through rates and creative performance, a multidisciplinary reality that aligns closely with the cross-topic interests of the DailyBusinesss.com audience.

What This Means for Leaders in 2026

For executives, founders, and investors, the evolution of digital marketing in 2026 carries several strategic implications. First, marketing capability is now a core driver of enterprise value, on par with technology, operations, and finance. Organizations that treat marketing as a downstream communication function will struggle to compete with those that embed it at the heart of product design, customer experience, and data strategy. Second, the talent equation has changed. Winning teams blend quantitative rigor with creative excellence, and they invest heavily in continuous learning to keep pace with AI, automation, and regulatory developments. Third, trust has become both a differentiator and a constraint. Brands that respect privacy, communicate transparently, and act responsibly with data and AI will enjoy a durable advantage in markets where consumers and regulators are increasingly skeptical of opaque practices.

Readers who follow DailyBusinesss Tech and DailyBusinesss AI will recognize that the underlying technologies driving this transformation are still in rapid flux. Foundation models are improving, new interfaces such as voice and gesture are gaining sophistication, and edge computing is enabling richer experiences on devices from smartphones to vehicles. Against this backdrop, the most resilient organizations are those that build adaptable architectures, modular processes, and cultures that are comfortable with experimentation and change.

Ultimately, the trajectory of digital marketing in 2026 reflects a broader shift in how businesses create and capture value in a connected world. The discipline has moved beyond pushing messages to orchestrating relationships, beyond buying attention to earning trust, and beyond isolated campaigns to continuous, data-informed experience design. For the global readership of DailyBusinesss.com, the key question is no longer whether to invest in digital marketing capabilities, but how to build them in a way that aligns technology, ethics, and long-term economic value. Those who answer that question with clarity and conviction will be best positioned to thrive in the years ahead.