Financial Mastery for First-Time Founders in 2026: A Strategic Guide from DailyBusinesss

In 2026, the difference between a promising idea and a durable company is increasingly defined by the quality of its financial decisions. Ambitious founders in the United States, Europe, Asia, and across the world are entering markets shaped by artificial intelligence, shifting capital flows, geopolitical uncertainty, and evolving regulatory regimes. On DailyBusinesss, where readers follow developments in business and markets, the recurring pattern is unmistakable: those who build strong financial foundations early are far more likely to navigate volatility, attract long-term partners, and scale sustainably.

Many founders are driven by product vision or a desire to solve a pressing problem in sectors such as fintech, AI, crypto, or sustainable commerce. Yet, without disciplined financial frameworks, even world-class innovation can stall. The most resilient companies in the United States, the United Kingdom, Germany, Singapore, and beyond are being built by leaders who treat financial literacy as a core competency rather than an administrative burden. They understand that credibility with investors, regulators, employees, and customers is earned through transparent numbers, prudent risk management, and thoughtful capital allocation.

This article examines how first-time founders in 2026 can integrate financial strategy into every stage of their journey, from early planning to global expansion, drawing on the themes that matter most to the DailyBusinesss audience: AI, finance, crypto, economics, employment, investment, and the future of trade.

Understanding the Financial Terrain of Modern Startups

Before a startup gains traction in the market, its prospects are often determined by how well the founding team understands the financial landscape in which it operates. In today's environment of higher-for-longer interest rates, persistent inflation in some regions, and rapid technological disruption, new ventures cannot afford to treat financial oversight as an afterthought. Founders need to read and interpret balance sheets, income statements, and cash flow statements with the same fluency that they apply to product roadmaps or user experience design.

A clear grasp of these core statements helps founders see beyond top-line revenue and focus on unit economics, gross margins, burn rate, and runway. By understanding how cost of goods sold, customer acquisition costs, and recurring operating expenses interact, leaders gain the ability to test scenarios, anticipate funding needs, and negotiate from a position of strength. Resources such as Learn more about core financial statements. can help demystify these concepts, but the real advantage comes when founders integrate them into weekly and monthly decision-making rather than delegating them entirely to accountants or advisors.

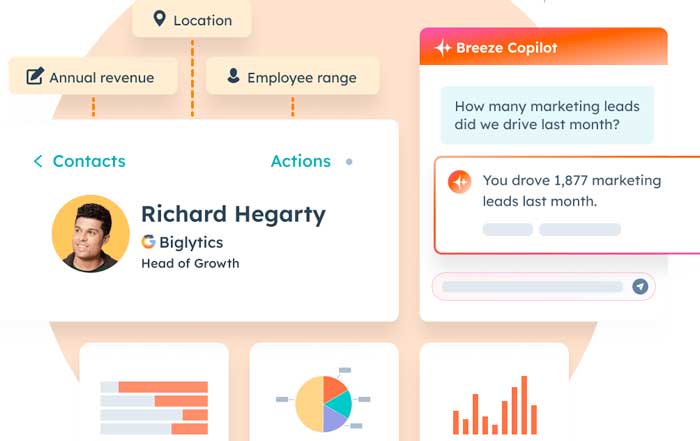

In 2026, founders also have access to sophisticated cloud-based tools that would have been out of reach for early-stage ventures a decade ago. Platforms that combine bookkeeping, analytics, and forecasting-often powered by AI-enable real-time visibility into cash positions, cohort performance, and revenue trends across markets such as North America, Europe, and Asia. When paired with a disciplined review cadence, these tools allow founders to adjust marketing spend, renegotiate supplier terms, or refine pricing before problems become existential. Readers who follow AI developments in business will recognize how machine learning-driven forecasting is reshaping how modern finance teams operate.

Yet technology does not replace judgment. Founders must still commit to budgeting as an ongoing discipline, building realistic forecasts for six, twelve, and twenty-four months, and stress-testing those forecasts against downside scenarios such as slower sales, delayed collections, or regulatory shifts in markets like the European Union or China. By mapping out different demand curves and cost trajectories, leaders can understand how much liquidity is needed to sustain hiring, R&D, and marketing without resorting to distressed capital. This is especially critical in sectors such as crypto and deep tech, where revenue timelines can be uncertain and regulatory environments fluid. To deepen understanding of macroeconomic headwinds that shape these dynamics, founders often monitor analysis from institutions such as the International Monetary Fund and OECD.

Designing a Financial Roadmap that Investors Trust

A financial roadmap is more than a spreadsheet; it is a narrative about how a company will transform capital into durable value. On DailyBusinesss, investors and founders alike pay close attention to whether a plan reflects realism, discipline, and adaptability. A credible roadmap begins with explicit assumptions about customer segments, pricing strategies, sales cycles, and product delivery timelines, and then translates those assumptions into revenue forecasts, expense plans, and capital requirements.

Founders who segment their budgets by function-product development, go-to-market, operations, and contingency-gain clarity on trade-offs. For example, a software startup targeting enterprise clients in the United States and Germany might allocate more upfront budget to sales engineering and compliance, while a consumer app scaling in Southeast Asia may prioritize user acquisition and localization. The roadmap should define key performance indicators such as monthly recurring revenue, churn, customer lifetime value, and payback period, and then tie each to specific initiatives and resource allocations. Those tracking markets and finance trends understand that investors increasingly scrutinize these metrics before committing capital.

Working capital management is a particularly critical element of the roadmap. It is common for first-time founders to underestimate the cash needed to bridge the timing gap between paying suppliers and collecting from customers, especially when selling into large enterprises in Europe or Asia that negotiate extended payment terms. By modeling collections patterns, inventory needs, and payroll obligations, founders can avoid liquidity crunches that force them into unfavorable financing or damage supplier relationships. Guidance from organizations such as the U.S. Small Business Administration and European Investment Bank can help founders understand options for credit lines, guarantees, and other working capital solutions.

A robust roadmap also incorporates risk analysis. This includes identifying potential shocks-such as regulatory changes affecting cross-border data flows, sudden shifts in interest rates, or supply chain disruptions in Asia-Pacific-and quantifying their financial impact. Founders who maintain a living document comparing actual performance against projections, and who transparently share those updates with stakeholders, signal maturity and accountability. That discipline is often a decisive factor for institutional investors and family offices surveyed in outlets like Harvard Business Review, which regularly highlight the importance of financial governance in scaling companies.

Aligning Capital Structure with Strategic Ambition

Capital is never neutral. The structure through which a startup raises funds-equity, debt, revenue-based financing, or hybrid instruments-shapes governance, decision-making speed, risk tolerance, and even culture. For readers of DailyBusinesss who follow investment and funding themes, the shift in 2026 is clear: founders no longer default to a single "Silicon Valley" model of aggressive equity financing and rapid burn, but instead tailor capital structures to sector dynamics and regional realities.

Equity financing from angel investors, venture capital firms, or corporate venture arms can be invaluable where speed, network access, and risk capital are paramount, such as in AI infrastructure, biotech, or frontier crypto protocols. Platforms like AngelList and Crunchbase provide visibility into investors' theses and track records, allowing founders to target partners who bring specific expertise. However, equity comes with dilution and governance implications. Founders must weigh how much control they are willing to cede, how board composition will evolve, and what expectations investors have for exit timelines, particularly in markets like the United States and the United Kingdom where IPO and M&A cycles can be cyclical.

Debt and quasi-debt instruments, including venture debt or revenue-based financing, can be appealing for ventures with more predictable cash flows, such as B2B SaaS or profitable e-commerce businesses in Europe and North America. These structures enable founders to retain more ownership but introduce fixed obligations that must be carefully matched to cash flow patterns. Institutions such as Silicon Valley Bank (now part of First Citizens) and regional lenders in Germany, Canada, and Singapore have developed specialized products for high-growth companies, but founders must analyze covenants, interest rates, and downside scenarios in detail.

Convertible notes and SAFEs remain popular at the pre-seed and seed stages, as they defer valuation debates until a later priced round. Still, founders must understand how valuation caps, discounts, and most-favored-nation clauses can compound dilution across successive rounds. Many experienced counsel and investors recommend modeling several future round scenarios to see how ownership evolves under different outcomes; practical primers on these instruments can be found through resources such as Y Combinator's SAFE overview and independent analysis from Startup-friendly legal guides.

Ultimately, the optimal capital structure is the one that best supports the company's mission, growth rate, and risk profile, while preserving enough flexibility to adapt to changing market conditions. Founders who can articulate this logic to potential backers, supported by coherent financial models, are more likely to secure favorable terms and to attract investors aligned with their long-term vision.

Balancing Liquidity with Long-Term Investment

One of the most delicate tensions in early-stage companies is the balance between preserving cash and investing aggressively in growth. Liquidity is the oxygen that keeps a startup alive during product iterations, sales cycles, and macro shocks. At the same time, underinvestment in product, brand, or talent can allow better-financed competitors in the United States, China, or Europe to capture market share that is difficult to reclaim later.

In 2026, founders have access to advanced forecasting and scenario-planning tools, many of which leverage AI to analyze historical transaction data, customer cohorts, and seasonal patterns. By using these tools to model cash inflows and outflows under conservative, base, and aggressive cases, leaders can identify when short-term credit might be needed, when to slow hiring, and when it is safe to accelerate marketing or expansion. Those who follow technology and AI coverage on DailyBusinesss will recognize how predictive analytics has become a staple of modern financial operations, even in relatively small ventures.

Hiring decisions are a critical expression of this liquidity-investment balance. Committing to senior full-time roles in engineering, sales, or compliance in markets like Germany, Japan, or Australia can significantly increase fixed costs, but also unlock new capabilities and revenue streams. Founders must evaluate whether expected incremental revenue or strategic advantage justifies the long-term commitment or whether more flexible arrangements via contractors, agencies, or nearshore teams make sense at a particular stage. Insights from organizations such as the World Economic Forum and ILO on labor trends and skills shortages can inform these decisions, particularly in high-demand areas like AI engineering and cybersecurity.

The same logic applies to geographic and product expansion. Entering a new country or launching a new product line often requires upfront spend on localization, compliance, and distribution, with payback periods that may stretch beyond initial expectations. Founders who integrate these initiatives into their liquidity planning, rather than treating them as opportunistic side projects, are better prepared to sustain them through the inevitable learning curve. Regularly revisiting the balance between runway preservation and growth investment, and adjusting based on real performance data, is one of the hallmarks of disciplined financial leadership.

Engineering Sustainable and Diversified Revenue Models

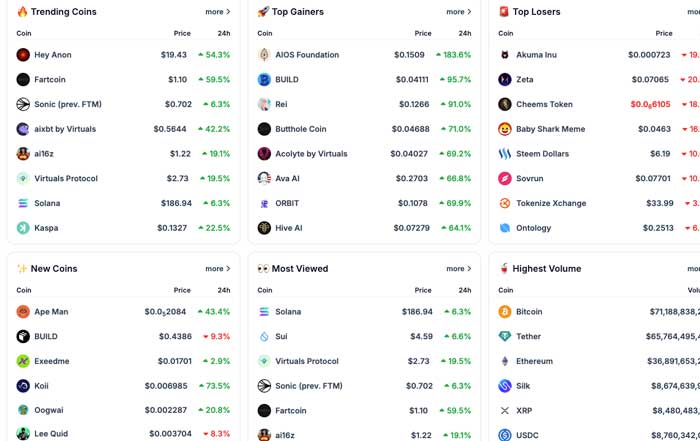

A sustainable revenue model is the backbone of long-term viability. In 2026, business models are evolving rapidly across sectors-from subscription-based AI tools used by enterprises in North America and Europe, to transaction-based fintech platforms in Africa and Southeast Asia, to tokenized ecosystems in Web3. For the DailyBusinesss audience, which closely follows crypto and digital asset developments, the lesson is consistent: revenue models must be tested rigorously against customer behavior, regulatory constraints, and unit economics.

Subscription and usage-based models remain attractive because they create recurring revenue and predictable cash flows. However, they demand meticulous attention to churn, onboarding, and customer success. Founders must track not only new sales but net revenue retention and expansion from existing customers, as these metrics are central to valuations in both private and public markets, as reported regularly by outlets such as The Wall Street Journal and Financial Times. Pricing experiments, tiered offerings, and value-based pricing strategies can all help align price points with perceived value in different regions, from the United States and Canada to Brazil and South Africa.

Many successful companies also diversify revenue through complementary services or licensing. An AI startup, for example, might generate primary revenue from SaaS subscriptions while adding consulting, training, or data-licensing streams. A hardware company in Germany or South Korea might augment device sales with maintenance contracts and software updates. This diversification can reduce dependence on any single product line or customer segment, providing resilience during downturns or competitive shocks. Insights from McKinsey & Company and similar strategy resources can help founders think systematically about portfolio expansion and monetization options.

Channel strategy is equally important. Selling directly via digital channels can preserve margins and enable closer customer relationships, but may require significant investment in performance marketing and customer support. Partnering with distributors, marketplaces, or incumbent players in markets like the United Kingdom, Italy, or Singapore can accelerate reach but often at the cost of lower margins and reduced control over end-customer experience. Founders need to analyze the full cost to serve across channels, including returns, support, and compliance, and then reflect those costs in pricing and margin targets.

Ultimately, sustainable revenue models are those that align customer value, cost structure, and capital intensity in a coherent way. They allow for experimentation and iteration while anchoring the company in a predictable financial base that can support long-term investment in innovation and people.

Navigating Tax, Regulation, and Legal Structure Across Borders

Regulatory and tax complexity has increased markedly as digital business models cross borders and as governments in North America, Europe, and Asia update frameworks for data, competition, and digital services. For first-time founders, especially those operating in fintech, crypto, or healthtech, legal and tax planning is not optional; it is a core risk-management function and a prerequisite for investor confidence.

The choice of legal entity and jurisdiction has immediate consequences for taxation, governance, and fundraising. Incorporating as a C-corporation in the United States, a GmbH in Germany, or a private limited company in Singapore each carries distinct implications for investor expectations, employee stock option plans, and cross-border operations. Comparative guidance from sources such as Gov.uk company formation resources or Enterprise Singapore can help founders understand local frameworks, but cross-border ambitions typically warrant specialized legal and tax counsel.

Tax compliance now extends far beyond corporate income tax. Digital businesses need to address sales tax and VAT obligations in multiple jurisdictions, especially as regions like the European Union refine their rules for digital services and marketplaces. Misclassification of transactions or failure to register appropriately can lead to penalties and reputational damage that are particularly harmful for young brands. Guidance from the OECD on international tax rules and from national tax authorities can help founders frame the right questions for their advisors.

Data protection and privacy regulations, most notably the EU's GDPR, the United Kingdom's data regime, and evolving frameworks in countries like Brazil and Thailand, impose strict requirements on how customer and employee data are collected, stored, and processed. Non-compliance can result in significant fines and loss of customer trust. Founders in AI, adtech, and consumer apps must integrate privacy-by-design principles into their products and ensure that contracts, consent mechanisms, and data-transfer arrangements align with current law. Guidance from regulators such as the European Data Protection Board and national authorities is an essential reference point.

By treating legal and tax compliance as strategic infrastructure rather than a late-stage clean-up exercise, founders not only avoid costly surprises but also enhance their attractiveness to institutional investors and large enterprise customers that conduct rigorous due diligence before signing contracts.

Managing Risk and Insurance in an Uncertain World

The past several years have underscored how quickly external shocks-pandemics, cyberattacks, supply chain disruptions, geopolitical tensions-can affect companies across continents. For founders building in 2026, risk management and insurance are not defensive luxuries; they are enablers of resilience and continuity.

Risk management begins with systematic identification and prioritization of threats. A logistics startup in Europe might focus on supply chain disruptions and fuel price volatility, while a fintech platform in the United States or Singapore may prioritize regulatory change and cybersecurity. Tools and frameworks from organizations such as the World Bank and ISO provide structured approaches to risk assessment and control design. Founders who maintain an internal risk register, review it regularly, and tie mitigation measures to budget and roadmap decisions demonstrate the kind of governance that serious investors seek.

Insurance complements internal controls by transferring certain financial risks to third parties. General liability, professional indemnity, cyber insurance, product liability, and D&O coverage are common components of a startup risk portfolio, particularly for ventures serving enterprise clients or operating in regulated sectors. Insurers and brokers active in markets such as the United Kingdom, Canada, and Australia increasingly offer tailored packages for SaaS, fintech, and healthtech companies, but founders must still carefully review exclusions, limits, and incident response obligations. Cyber insurance, for example, often requires specific security controls as a condition of coverage.

Equally important is business continuity planning. This includes documented procedures for maintaining operations during disruptions, backup and recovery mechanisms for critical data, and communication plans for employees, customers, regulators, and the media. Regular testing through tabletop exercises or simulations can reveal gaps and build organizational muscle memory. For readers following world and trade dynamics on DailyBusinesss, the connection is clear: companies with robust continuity planning are better positioned to navigate conflicts, natural disasters, and infrastructure failures that affect global supply chains and digital networks.

Building Investor Trust Through Governance and Communication

As soon as external capital enters the cap table, founders are not only operators but stewards of other people's money. Governance and investor relations therefore become central to long-term success. Investors in the United States, Europe, and Asia increasingly expect structured reporting, clear decision-making processes, and transparent handling of conflicts and setbacks.

Effective governance begins with an appropriately composed board of directors or advisors. A balanced board might include founders, major investors, and independent members with deep expertise in relevant sectors such as AI, financial services, or global operations. The best boards challenge assumptions, help calibrate risk appetite, and support management in strategic decisions rather than micromanaging day-to-day operations. Regular, well-prepared meetings with clear agendas and materials-financial performance, key risks, strategic options-are essential to making this structure work.

Investor communication should be consistent, candid, and forward-looking. Monthly or quarterly updates that highlight revenue, cash position, key metrics, hiring, product milestones, and risks help investors understand the trajectory and context of decisions. When challenges arise-missed targets, regulatory issues, security incidents-early disclosure and a concrete remediation plan build trust. Many experienced founders and investors share best practices on platforms like First Round Review and similar resources, emphasizing that trust, once lost, is difficult to regain.

Strong governance and communication also make future fundraising easier. New investors often ask existing backers about their experience working with the founding team, and will review historical board minutes and reporting. A track record of disciplined financial management, responsible risk-taking, and honest communication can materially improve valuation and terms, especially in more selective capital markets such as those in 2026.

Scaling Across Borders with Financial Discipline

Ambitious founders increasingly design for global reach from day one, whether targeting enterprise clients across Europe and North America, consumer markets in Asia, or cross-border trade flows in Africa and South America. Yet international expansion magnifies every financial decision: costs, risks, and complexity all scale alongside opportunity.

The first step in financially responsible scaling is rigorous market selection. Not every country offers the same regulatory openness, purchasing power, or competitive landscape. Founders must evaluate factors such as ease of doing business, digital infrastructure, labor availability, and sector-specific regulation. Data from sources like the World Bank's Doing Business indicators and UNCTAD can help compare markets, while on-the-ground partnerships provide nuance that statistics alone cannot capture.

Once target markets are chosen, founders must align operating models, legal structures, and capital plans. Establishing subsidiaries, hiring local teams, or entering joint ventures all carry distinct financial and governance implications. Currency risk management becomes essential when operating across the euro, dollar, pound, yen, or emerging market currencies. Hedging strategies, multi-currency accounts, and local financing options may all be part of the toolkit, particularly for companies with material revenue or costs in multiple regions.

For the DailyBusinesss audience, which follows trade and global business trends, the pattern is evident: the companies that succeed internationally are those that treat expansion as a disciplined, staged process rather than a marketing headline. They pilot in one or two priority markets, refine their model based on local feedback, and only then scale into additional geographies, supported by robust financial and operational infrastructure.

A Long-Term Financial Ethos for Founders in 2026

The most successful founders in 2026 are not those who simply chase capital or headlines, but those who build organizations grounded in financial clarity, ethical conduct, and strategic patience. Across the themes that matter to DailyBusinesss readers-AI, finance, crypto, sustainable business, employment, and global trade-the underlying principle is the same: enduring value is created when visionary ideas are matched with rigorous financial stewardship.

This stewardship shows up in many forms: an honest forecast that tempers ambition with data; a capital structure that supports both growth and resilience; a revenue model that aligns customer value and cost to serve; a compliance posture that anticipates regulatory evolution; and a risk framework that acknowledges uncertainty without being paralyzed by it. It also appears in the way founders treat employees and communities, recognizing that trust-internally and externally-is a financial asset as much as a cultural one. Readers interested in how these themes connect to sustainability can explore sustainable business perspectives, where financial resilience and environmental responsibility increasingly converge.

For first-time founders, the path can seem daunting. Yet every enduring company in the United States, Europe, Asia, Africa, or South America began with leaders who were willing to learn, adapt, and surround themselves with expertise. By leveraging the growing ecosystem of tools, mentors, and knowledge-from global economic analysis to technology insights-emerging entrepreneurs can transform financial uncertainty into strategic advantage.

On DailyBusinesss, the stories that resonate most are those where founders consciously align numbers with narrative, capital with conviction, and risk with responsibility. In doing so, they not only increase their odds of commercial success but also contribute to a more resilient, innovative, and trustworthy global business ecosystem.