Remote Work in 2026: How Distributed Teams Are Redefining Global Business

Remote work in 2026 has moved beyond being an emergency response or a temporary perk and has become a structural pillar of modern business strategy. For the readers of DailyBusinesss.com, whose interests span artificial intelligence, finance, global markets, crypto, economics, founders, and the broader future of work, the remote revolution is no longer an abstract trend; it is the operating system underpinning how competitive organizations in the United States, Europe, Asia, and beyond are built, financed, and scaled. The question is no longer whether remote work will persist, but how leaders can design remote-first or hybrid models that demonstrate genuine expertise, operational excellence, and long-term trustworthiness in front of investors, regulators, employees, and customers.

In this environment, remote work is tightly interwoven with developments in advanced collaboration technologies, digital finance, labor market restructuring, and cross-border trade. It shapes how founders structure their first ten hires, how multinational corporations reconfigure real estate portfolios, and how governments in countries such as the United Kingdom, Germany, Singapore, and Canada adapt regulatory frameworks for tax, data protection, and employment rights. For business leaders following the analysis on DailyBusinesss Business coverage, the remote work story is, at its core, a story about strategic advantage, capital allocation, and the ability to execute consistently across borders and time zones.

From Pandemic Shock to Permanent Strategy

The evolution from experimental telecommuting to mainstream remote work was catalyzed by the global disruptions of the early 2020s, but by 2026 it has become clear that remote work is now embedded as a deliberate strategic choice rather than a crisis workaround. Organizations across North America, Europe, and Asia have absorbed several years of data on productivity, retention, and cost structures, and many boards now treat remote capability as a resilience and competitiveness benchmark in the same way they evaluate cybersecurity or capital adequacy. Leaders track how distributed work influences margins, innovation cycles, and access to scarce skills, integrating these insights into long-term planning and investment decisions that are closely followed by readers of DailyBusinesss Investment insights.

The normalization of remote work has been supported by expanding digital infrastructure and the rapid maturation of cloud-based collaboration ecosystems. High-capacity broadband, 5G and emerging 6G networks, and enterprise-grade software-as-a-service platforms have allowed businesses to orchestrate complex workflows across continents. Executives at firms such as Microsoft, Google, and Salesforce have invested heavily in integrated toolsets that connect messaging, project management, document collaboration, and analytics, enabling organizations to operate with distributed teams that rival or even exceed the coordination standards of traditional office-centric models. Readers can explore how these platforms intersect with broader technology trends through DailyBusinesss technology analysis.

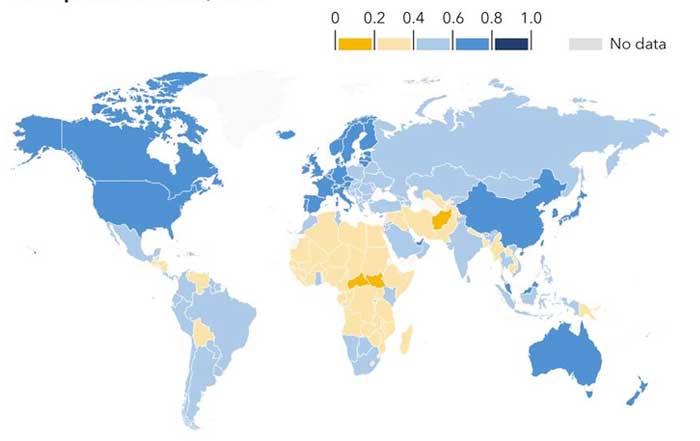

Crucially, remote work is no longer confined to technology startups or digital agencies. Financial institutions, consulting firms, advanced manufacturers, and even healthcare providers have integrated remote or hybrid elements into core operations. Analysts at organizations like the OECD and World Economic Forum have documented how remote work has influenced labor participation, urban real estate, and regional economic development, with secondary cities in countries such as Spain, Canada, and Australia benefiting from inflows of high-earning remote professionals who are no longer bound to metropolitan headquarters. Learn more about how remote work is reshaping regional economics and productivity through resources such as the OECD Future of Work and the World Economic Forum's insights on the future of jobs.

Technology as the Fabric of Distributed Operations

The remote work model in 2026 rests on a technology stack that is significantly more sophisticated than the video calls and chat applications that dominated the early transition. Artificial intelligence, automation, and secure cloud computing now form the backbone of distributed operations. For business readers tracking AI's role in productivity on DailyBusinesss AI coverage, the remote work story offers a practical case study in applied AI at scale.

AI-enabled scheduling and coordination tools automatically account for time zones across Europe, Asia, North America, and Africa, recommending meeting times that respect local working hours and cultural norms. Intelligent assistants summarize meetings, generate action lists, and track follow-ups, reducing administrative burden for managers and freeing teams to focus on analysis, design, and client engagement. Platforms such as Google Workspace and Microsoft 365 integrate these capabilities into everyday workflows, embedding AI into documents, email, and project timelines.

Beyond productivity tools, remote work is increasingly supported by immersive technologies. Virtual and augmented reality environments allow distributed teams to meet in shared digital spaces that simulate physical offices, design studios, or training centers. Engineers and architects in Germany, South Korea, and the United States can walk through virtual prototypes together, while product teams in Japan and the Netherlands use augmented reality overlays to test design concepts in real-world contexts. For a deeper perspective on how immersive technologies are reshaping collaboration, executives often turn to research and guidance from organizations like McKinsey & Company, whose insights on the future of work and technology explore these developments in depth.

Security and compliance considerations have evolved alongside these tools. Distributed workforces expand the potential attack surface for cyber threats, pushing organizations to adopt zero-trust architectures, endpoint protection, and advanced monitoring. Leading security firms and public agencies highlight the importance of multi-factor authentication, encrypted communication channels, and continuous training to mitigate phishing and ransomware risks. Business leaders can reference guidance from the U.S. Cybersecurity and Infrastructure Security Agency or the European Union Agency for Cybersecurity to strengthen their remote security posture.

Cloud infrastructure remains the enabler that ties these elements together. Enterprises rely on hyperscale providers to host critical applications and data, using virtual private networks, identity management, and fine-grained access controls to ensure that remote teams can work from anywhere without compromising confidentiality or regulatory obligations. As highlighted in DailyBusinesss Tech section, the interplay between cloud scalability, AI-driven automation, and remote-friendly tools is now central to digital transformation roadmaps across industries.

Cultural and Leadership Shifts in a Remote-First World

If technology is the fabric of remote work, culture and leadership are the stitching that holds it together. By 2026, experienced executives recognize that tools alone cannot deliver sustainable performance; distributed teams require deliberate norms, trust-based management, and a redefinition of what effective leadership looks like. The move from presence-based assessment to outcome-based evaluation has become a hallmark of mature remote organizations, and this shift is closely watched by investors and employment analysts following DailyBusinesss employment coverage.

Managers in remote-first companies increasingly act as facilitators and coaches rather than supervisors of day-to-day activity. They set clear objectives, define measurable key results, and provide the resources and context teams need to execute, while avoiding the micromanagement that can quickly erode trust in a distributed setting. Performance reviews prioritize deliverables, quality of work, client impact, and collaborative behavior over hours logged or physical attendance. This approach aligns with frameworks promoted by organizations such as Harvard Business School, whose Managing the Future of Work initiative examines how leadership practices must adapt to flexible and remote models.

Communication norms have been reengineered around asynchronous collaboration. Global companies often adopt overlapping "core hours" to facilitate real-time interaction while still allowing employees in regions from Singapore to Brazil to design their schedules around local constraints. Outside these windows, documentation, shared workspaces, and recorded briefings ensure continuity. Leaders encourage written clarity, structured updates, and accessible knowledge bases so that decisions and rationales are transparent and traceable, which is particularly important for regulated sectors like finance and healthcare.

Remote work also amplifies the importance of diversity, equity, and inclusion. When organizations recruit globally, they gain access to talent from South Africa, India, Scandinavia, Latin America, and beyond, bringing a wider range of perspectives into product design, risk assessment, and strategic planning. However, this diversity must be supported by inclusive practices that account for cultural differences in communication style, work expectations, and feedback norms. Resources from the Society for Human Resource Management and similar organizations offer frameworks for building inclusive remote cultures that respect these differences while maintaining shared standards of professionalism and accountability.

Mental health and well-being have become central components of remote culture. The absence of physical separation between home and office can blur boundaries, increasing the risk of burnout. Leading employers now integrate mental health benefits, counseling access, and training on digital boundaries into their core employee value proposition. The World Health Organization provides guidance on mental health in the workplace, and many organizations adapt such recommendations to remote-specific realities, including screen fatigue, isolation, and the pressure to remain "always on."

Global Talent Markets and New Recruitment Models

Remote work has reshaped the global talent marketplace in ways that directly intersect with readers' interests in investment, founders, and employment dynamics on DailyBusinesss Founders section and DailyBusinesss economics coverage. By 2026, organizations ranging from early-stage startups to established multinationals recruit routinely across borders, competing for engineers in Eastern Europe, designers in France, data scientists in India, product managers in the United States, and compliance experts in Switzerland, often within the same team structure.

Recruitment processes have been redesigned for a digital-first environment. Video interviews are now the baseline rather than the exception, but leading companies go further, incorporating collaborative exercises, live problem-solving sessions, and asynchronous case studies that simulate real remote work conditions. Hiring managers review not only résumés but also digital portfolios, GitHub repositories, and evidence of previous contributions to distributed teams. Platforms such as LinkedIn and Indeed continue to serve as central nodes in this ecosystem, while specialized remote job boards and talent marketplaces connect employers with seasoned remote professionals who understand the discipline and communication skills required for success outside a traditional office.

Onboarding has likewise become a strategic differentiator. High-performing organizations invest in structured virtual onboarding journeys that may span several weeks, combining self-paced learning modules, live sessions with leadership, mentorship programs, and clear documentation. This structured approach is particularly important for compliance-heavy sectors like finance and crypto, where misaligned expectations or misunderstood procedures can have regulatory consequences. Readers following DailyBusinesss finance coverage and DailyBusinesss crypto analysis will recognize how critical it is for financial institutions and digital asset platforms to ensure that remote employees fully understand risk, security, and reporting obligations from day one.

The rise of remote work has also accelerated the growth of the global freelance and contractor economy. Organizations use platforms dedicated to remote talent to assemble project-based teams for specialized initiatives such as AI model development, ESG reporting, or market entry research in new regions. Sites like Remote.co and other niche marketplaces for developers, designers, and consultants enable companies to flex capacity up or down without committing to permanent headcount. This flexibility aligns with the increasingly dynamic capital allocation strategies observed in venture-backed startups and publicly listed firms alike.

For employees and independent professionals, remote work has expanded access to higher-value opportunities regardless of geography. Skilled workers in countries such as Thailand, Brazil, and South Africa can now compete for roles with U.S., European, or Singaporean employers without relocating. At the same time, competition has intensified, prompting many professionals to invest in continuous upskilling through platforms like Coursera or edX to remain competitive in a global market where employers can compare candidates from dozens of countries for a single role.

Regulatory, Tax, and Policy Complexity

The cross-border nature of remote work has forced policymakers, regulators, and corporate legal teams to confront a complex web of tax, employment, and data protection issues. By 2026, many governments have updated frameworks to reflect the reality that a software engineer in Italy might be employed by a Canadian startup, report to a manager in the United Kingdom, and serve clients in Singapore, all without physically crossing a border. Readers tracking these developments through DailyBusinesss world coverage and DailyBusinesss trade insights will recognize that remote work is now an integral component of international economic policy.

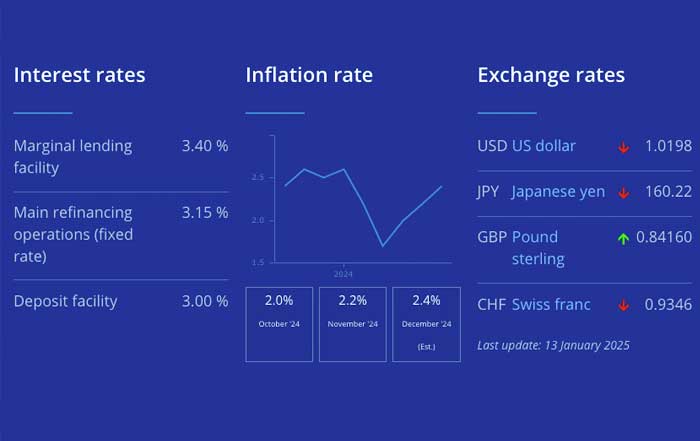

Taxation remains one of the most challenging areas. Remote employees can create permanent establishment risks for their employers, potentially triggering corporate tax obligations in jurisdictions where the company has no physical office. Double-taxation treaties and guidance from bodies such as the OECD have been updated to address these scenarios, but interpretation and implementation vary across countries. Companies increasingly rely on global employment platforms, specialized legal counsel, or employer-of-record services to manage payroll, social contributions, and tax withholding in multiple jurisdictions, particularly in Europe and Asia-Pacific.

Labor law compliance is equally complex. Remote employees are often entitled to protections under the laws of their country of residence, including minimum wage standards, working time regulations, leave entitlements, and termination procedures. Organizations with distributed teams across Germany, France, Japan, and Australia must align policies with multiple legal regimes, which can differ significantly in areas such as overtime, collective bargaining, and employee representation. Guidance from institutions like the International Labour Organization helps frame global principles, but operational execution remains a company-level responsibility.

Data protection and privacy regulations have also intensified in scope and enforcement. The European Union's GDPR continues to influence legislation worldwide, with countries such as Brazil, South Korea, and Canada implementing or updating comprehensive data protection laws that apply to remote processing of personal data. Remote employees accessing customer information from home offices or co-working spaces must adhere to strict protocols regarding device security, network usage, and data transfer. Regulators and data protection authorities in multiple regions have issued specific guidance on remote work, emphasizing encryption, access controls, and clear governance structures.

Another emerging policy area in 2026 is the "right to disconnect." Several European countries, including France and Spain, have introduced or strengthened regulations limiting employer expectations around after-hours communication, seeking to protect employees from the constant connectivity that remote work can encourage. These developments intersect with organizational well-being strategies and are closely watched by HR leaders seeking to maintain compliance while sustaining high levels of engagement and performance.

Strategic Challenges and Risk Management

Despite its advantages, remote work introduces strategic risks that require disciplined management. For business leaders and investors reading DailyBusinesss markets coverage, understanding these risks is essential to evaluating the resilience and scalability of remote-heavy organizations.

One of the most discussed concerns is the potential erosion of informal knowledge transfer and organizational cohesion. In a fully remote or heavily hybrid environment, junior employees may have fewer opportunities to observe senior colleagues, absorb tacit knowledge, or engage in spontaneous problem-solving. To counter this, many organizations design intentional mentorship programs, virtual shadowing opportunities, and structured cross-functional projects. Some also schedule periodic in-person retreats or regional gatherings to reinforce relationships and shared culture, treating physical meetings as high-value strategic investments rather than routine overhead.

Burnout and boundary management remain significant issues. Without the physical transition of commuting, employees in markets from the United States to Japan can find themselves extending working hours to accommodate global time zones or internal expectations. Companies are responding by monitoring workloads, encouraging the use of leave, and training managers to recognize early signs of overwork. Mental health support, wellness stipends, and education on digital hygiene have become standard in many corporate benefit packages, reflecting the growing recognition that sustainable performance in remote environments depends on proactive well-being strategies.

Cybersecurity risk is another persistent challenge. Home networks, personal devices, and public Wi-Fi connections can all introduce vulnerabilities. Organizations are increasingly mandating the use of corporate-managed devices, enforcing endpoint encryption, and deploying advanced threat detection systems. Employee training is treated as a continuous process rather than a one-time exercise, with simulated phishing campaigns and regular briefings on emerging threats. Resources from agencies like the National Cyber Security Centre in the UK provide practical frameworks that businesses can adapt to their own remote environments.

Finally, equity and career progression in hybrid models require careful attention. Employees who are primarily remote may fear being overlooked for promotions compared to colleagues who spend more time in physical offices. Forward-thinking companies are responding by standardizing promotion criteria, using transparent performance metrics, and ensuring that key meetings and decision-making processes are accessible virtually. This is particularly important for organizations that pride themselves on inclusive cultures and global talent strategies, where any perception of proximity bias can undermine trust.

The Road Ahead: Remote Work as a Core Business Competency

Looking beyond 2026, remote work is poised to become less of a discrete topic and more of an embedded competency within broader business strategy. For readers of DailyBusinesss.com, this means that discussions of AI deployment, capital markets, sustainable business, and trade policy will increasingly assume remote capability as a given rather than a novelty. Remote work will intersect with environmental, social, and governance (ESG) priorities as companies quantify the impact of reduced commuting on emissions and consider how digital inclusion strategies can expand opportunity to underrepresented regions. Learn more about sustainable business practices and their link to work models through UN Global Compact resources and World Bank insights on digital development.

Artificial intelligence will deepen its integration into remote workflows, not only automating routine tasks but also assisting with capacity planning, skills mapping, and personalized learning paths for employees. Advanced analytics will help leaders identify collaboration bottlenecks, assess engagement levels, and design interventions that support both performance and well-being. At the same time, ethical considerations around algorithmic monitoring, data privacy, and fairness will require strong governance frameworks, transparent communication, and adherence to evolving standards from organizations such as the OECD AI Observatory.

Infrastructure improvements will continue to expand the reach of remote work into new geographies. Satellite internet constellations, fiber investments, and 5G/6G deployments will lower connectivity barriers in parts of Africa, South America, and Southeast Asia, opening new talent pools and enabling local entrepreneurs to build globally connected ventures without relocating. This trend aligns with broader shifts in global trade and investment patterns, which readers can explore further through DailyBusinesss world and news coverage.

Ultimately, the organizations that excel in this era will be those that treat remote work not as a cost-cutting measure or employee perk, but as a strategic discipline requiring investment, experimentation, and continuous refinement. They will demonstrate experience by operating distributed teams successfully over multiple cycles, expertise by integrating technology, culture, and regulation into coherent operating models, authoritativeness by shaping industry standards and sharing best practices, and trustworthiness by protecting employee well-being, data, and rights across borders.

For the global business community that turns to DailyBusinesss.com for insight into AI, finance, crypto, markets, and the future of work, remote work in 2026 is best understood as a defining feature of competitive advantage. It enables organizations to access the world's talent, serve clients in every time zone, and adapt quickly to economic and geopolitical shifts. Those who master the balance between digital efficiency and human connection will not only navigate the present landscape but also shape the blueprint for how work, collaboration, and value creation will function in the decades ahead.